- The Reserve Bank of Australia held rates but discussed the possibility of hiking.

- The US released data showing weaker-than-expected retail sales.

- Business activity data revealed a bigger-than-expected expansion in the US manufacturing and services sectors.

The AUD/USD weekly forecast is slightly bullish as the Aussie maintains its edge due to a hawkish central bank.

Ups and downs of AUD/USD

The AUD/USD pair had a bullish week as the Australian dollar strengthened after the RBA policy meeting, and the US dollar fluctuated amid mixed data. The Reserve Bank of Australia held rates but discussed the possibility of hiking, given the high inflation. This led to a decline in bets for a cut in December.

–Are you interested in learning more about next crypto to explode? Check our detailed guide-

Meanwhile, the US released data showing weaker-than-expected retail sales. This was another sign of poor economic activity that could push the Fed to cut interest rates. However, as the week ended, business activity data revealed a bigger-than-expected expansion in the manufacturing and services sectors.

Next week’s key event for AUD/USD

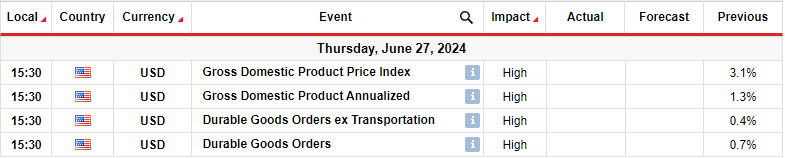

Next week, investors will focus on data from the US, including GDP and durable goods orders. These reports will have a big impact on Fed rate cut expectations. Recent data from the US, including the last GDP report, have indicated a slowdown in the economy. This was also seen in the retail sales report. If this trend continues next week, the likelihood of a September rate cut by the US central bank will increase.

However, if there is a shift, as seen in the PMI data on Friday, the Fed will likely only cut once this year.

AUD/USD weekly technical forecast: Price action confined between 0.6580 and 0.6701

On the technical side, the AUD/USD price is trading in a tight range between the 0.6580 support and the 0.6701 resistance level. Initially, the price bounced from the 0.6401 support level, pushing above the 22-SMA. This indicated a shift in sentiment to bullish.

–Are you interested in learning more about forex tools? Check our detailed guide-

However, bulls could only push the price as high as the 0.6701 resistance level, near the 0.618 Fib level. This is where the price entered a period of consolidation. Bears and bulls are battling for control within this range area.

Therefore, this consolidation might continue in the coming week. However, if one side wins, there is a higher chance the price will break above 0.6701 since the previous move was bullish.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.