The BOE unanimously decided to leave all its policy unchanged as widely expected. More importantly, the inflation outlook is mostly unchanged.Some members signal concern about inflation, but forecasts make the difference. The BOE prefers seeing the glass half empty.

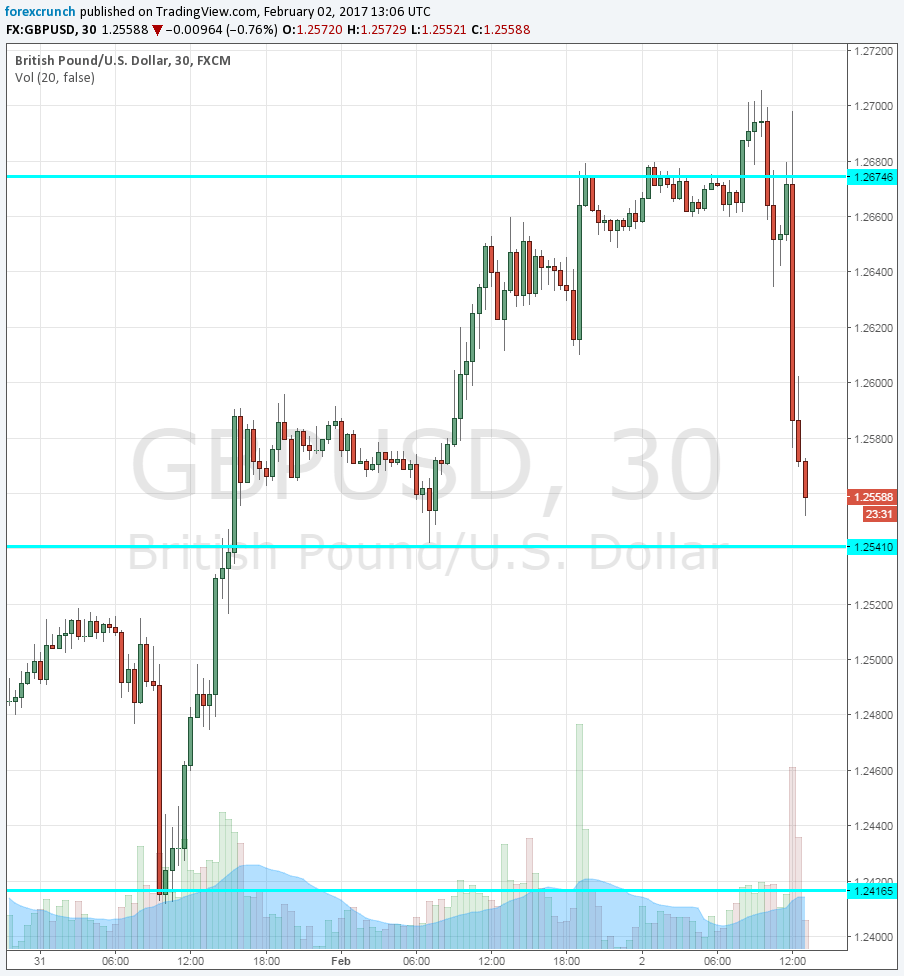

GBP/USD initially advanced but then fell.

They see a delayed slowdown in real income growth. They expect inflation to hit 2.72% in 2017. GDP is expected to grow 0.5% in Q1 2017 and 2% for the whole year, up from 1.4%.

Carney’s press conference

The Governor described the shift in growth forecasts as mostly related to the fiscal measures that the government has taken. The rest is the better global environment and other measures.

In order to tighten policy, the BOE would need to see higher wages. It is basically taking the rising prices due to the weaker pound with a stride.

They would probably loosen monetary policy if consumer spending and credit would be hurt. All in all, the BOE is firmly neutral and did not go hawkish.

This is what sends the pound lower. The new low is 1.2552, already 150 pips below the highs of the day.

More: GBP: Heading For A Hard Brexit: S/T & L/T Outlook & Targets – SEB

BOE Background

The Bank of England was predicted to raise growth and inflation forecasts for 2017. The BOE releases its rate decision (no change expected) and the Quarterly Inflation Report which is followed by a press conference by Governor Mark Carney.

Previous projections were based on the damage from Brexit, but the economy has performed quite well. In addition, the low exchange rate of the pound has pushed inflation higher.

The bigger question relates to future monetary policy. The BOE moved from a dovish stance in August to a neutral one in November, saying that the next move in interest rates can be either up or down. While the economy is humming along and CPI is increasing, the Bank is likely reluctant to raise rates given the uncertainty from Brexit.

GBP/USD was trading around 1.2650 ahead of the event. It had already topped 1.27 earlier in the day, defying gravity and weak data. The US dollar has been suffering from Trump’s tweets.

Follow our live coverage of the event: