Article 50 is set for March 9th. Brexit is still Brexit. What’s next for the pound?

UK TOWARDS A ‘HARD BREXIT’. It took more than 6m after the vote on EU-membership before the government revealed its plan for Brexit. However, now it is clear that a ‘hard Brexit’ where British access to the single market at best will be replaced with free trade agreement is the way forward.

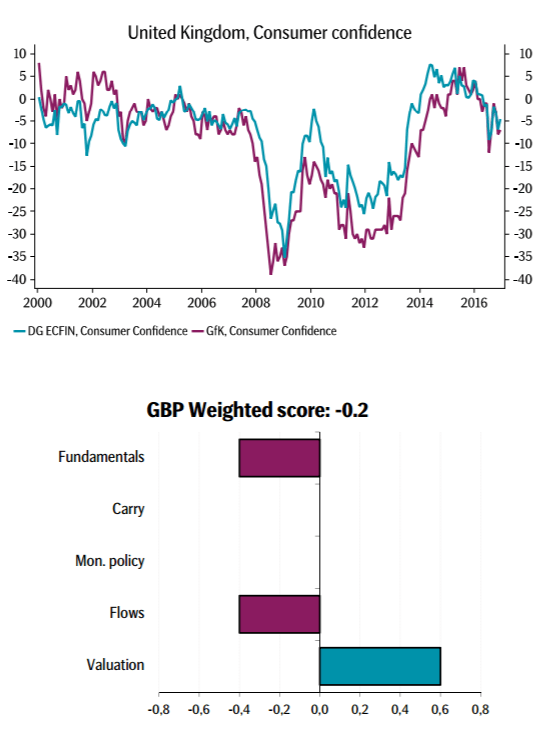

Although the transition process will be phased out uncertainty regarding the Brexit impact on UK growth is likely to weigh on the GBP. We expect EUR/GBP to peak at 0.89 in Q1 before moving lower again.

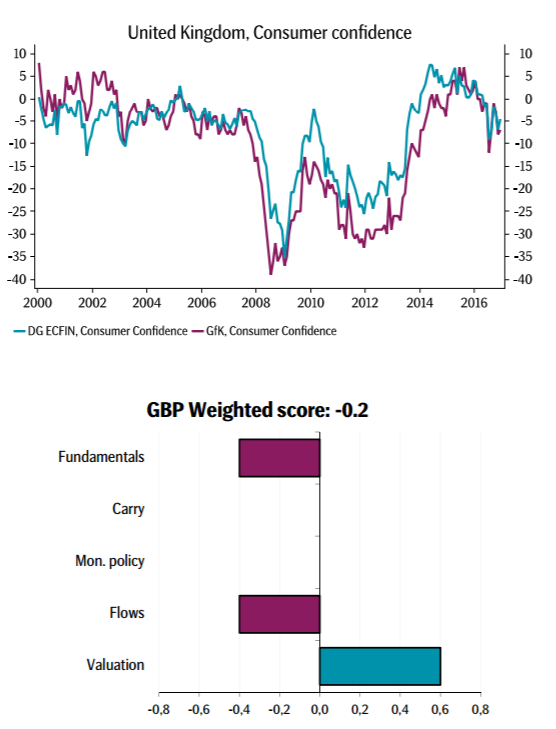

SHORT-TERM: So far the British economy has done better than anticipated after the referendum. In 2016 growth was actually stronger than the previous year. The large depreciation of the GBP is one reason. However, already now there are some worrying signs that growth might slow going forward and this risk has definitely increased after the government Brexit plan was revealed. Businesses are likely to delay capital spending, which already is reflected in falling investment intentions and household consumption, which has been the main driver for growth since 2013, might slow. Consumer confidence only had a short-lived recovery after the drop last summer and the labour market activity show signs of slowing. Moreover, the household savings rate has dropped to the lowest level since the beginning of 2009 while rising inflation undermines real wage growth.

LONG-TERM: The GBP is significantly undervalued after its depreciation. However, considering uncertainty from Brexit it seems very reasonable at this point. Twin deficits is another negative factor for the GBP. The current account deficit is 5.2% of GDP, which certainly is a risk for the currency.

SEB targets GBP/USD at 1.24 by the end of Q1 and at 1.20 by the end of Q2.