On Thursday the Bank of England has an interest rates decision to make and forex day traders are primed to make their moves. Although no change in the rate is expected, the deliberations of the money policy committee (MPC) will receive close attention regarding asset purchase tapering and any shifts in attitude towards inflation.

There’s a lot for the Bank to balance. The consensus is that it has time to wait before having to make a move, but that assumes the situation in the markets does not deteriorate.

Also the BoE meeting is one of 13 central banks that are also meeting this week, most notably the US but including Brazil and Australia.

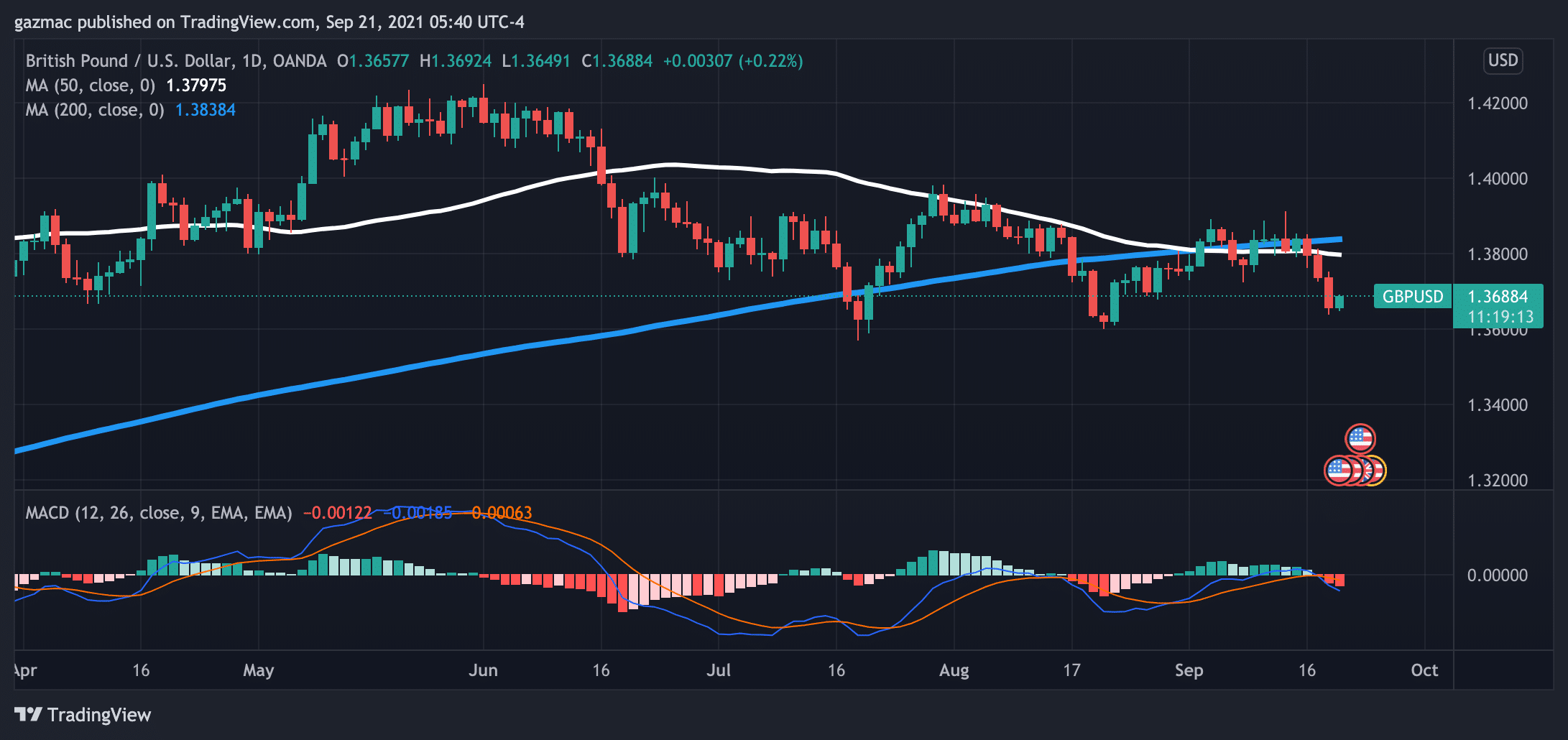

GBP/USD is up 33 pips at 1.3688 at the time of writing, clawing back ground from yesterday’s losses against the buck. Meanwhile, the euro is lower against the pound, with EUR/GBP off 10 pips at 0.8573.

China credit crisis looms – what does it mean for UK and global growth?

What is going in China may be more pressing than developments in the US at this juncture. If the US recovery starts to splutter then the market has got used to the idea that China would pick up the slack. Well, that crutch is no longer there and Evergrande is one sign of that.

The FX markets are being buffeted by the Evergrande developments so you may want to check out automated forex trading to take advantage of these fast-moving developments – click the link and read our guide.

The clampdown on the tech sector looks it will soon be followed by real estate. The country is also cutting back on steel production – which is related to the property markets as the government tries to clampdown on property prices – and that has led to plummeting iron ore price.

Coal prices are spiking too, with 70% of the country’s energy supplied by that source. What this call all add up to is some of the heat being taken out of the recovery and that could help put central banks on the inflation front. But don’t count on it.

Gas shock in Europe and UK sign of more inflation to come

Even if China fails to keep growing at a sufficient pace to maintain the forward march out of the pandemic for the world’s economy, it doesn’t necessarily mean that energy prices are going to uniformly fall. Natural gas prices for example, which are spiking worldwide and is creating an inflation crisis in Europe, are staying high. However, crude oil prices are slipping.

The gas crisis in Europe comes at a delicate time. The UK is much more dependent than other advanced countries for gas to generate electricity. It also has the least storage capacity in Europe.

Your capital is at risk

All this speaks to the stripped back nature of supply chains and the just-in-time processes in industry. The knock on effect from the gas price shock has led to a carbon dioxide shortage – a gas that is harvested as a byproduct of fertiliser production and has become prohibitively expensive to carry on producing. CO2 is used widely in agriculture as well as other industries and threatens meat and poultry production as well as other foodstuffs that rely on CO2 for freezing.

However, what could be a looming credit crisis in China, could kill off growth in the country.

So the BoE MPC has some contradictory currents to wrestle with.

If you are thinking of trading around the central bank meeting this week, you may want to try out some MT5 forex brokers. Before you do so, check out our guide

BoE unlikely to intervene aggressively if there’s an equities correction

Then there’s the equity markets to consider. If the bull market has reached its twilight moment for the S&P and the FTSE, so too might be the days of the central banks intervening to support asset classes. The ‘Fed put’ will be tested if yesterday’s sell-off proves to be a harbinger of more downdraft to come.

But the BoE’s reaction to instability in the financial markets is surely unlikely to lead to an expansion of its bond buying. Instead we are more likely to see injections of liquidity.

The Bank of England and the UK economy are in a somewhat more exposed position. The central bank, in line with its peers elsewhere, wants to see strong growth, but not too strong that it creates sustained inflationary pressures. Meanwhile it doesn’t want to over do it on asset purchases while the economy is still moving forward by over-egging the pudding.

UK Inflation jumps to 3.2%, GDP growth flatlines

The UK was already grappling with a shortage of heavy goods vehicle drivers, which was leading to wage push in prices. But there are widespread labour shortages elsewhere, especially in the hospitality industry. Transport costs, energy hikes, wage growth – are all key producer inputs and are forcing manufacturers and service provider to raise prices.

Last week UK inflation jumped to 3.2% year on year and saw its biggest monthly rise ever. It is going to harder for the MPC to hold the line on inflation being “transient” when it is proving to be much stickier than previously anticipated.

On the growth side, GDP for July registered some way below expectations, recording an advance of just 0.1% compared to the 0.5% forecast. The flatlining GDP number was the slowest monthly growth figure since the beginning of the year.

Playing a large part in holding back the economy are the supply-chain constraints, most acutely manifested in the labour market.

BoE preview: stagflation returns?

Commenting on the combination of slowing growth and inflationary pressures, Susannah Streeter, senior investment and markets analyst at UK broker Hargreaves Lansdown, said: “Companies in industries right across the board are warning of problems. If fewer cars roll off production lines, if drivers aren’t available to deliver goods and if shelves go bare, then the only way for output to go is down.”

On the other hand AJ Bell’s Danni Hewson has a more optimistic outlook on the progress of the UK recovery: “Isolation rules have been relaxed, much to the relief of employers up and down the country, the vaccination roll out has continued apace and Delta variants appear to have been kept at bay,” she observed last week.

We could add to that the removal of many airline travel restrictions as another significant booster.

However, the MPC may not utter the dread word ‘stagflation’, but it may not be far from their minds. The prospect of elevated inflation combined with slow growth – UK growth is still 2.1% below pre-pandemic levels – is not an enviable one for policymakers to contend with.

Economists are not expecting more than perhaps one MPC member to vote to start winding down asset purchases at this point and a rate rise unlikely until the second half of next year at the earliest.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.