While some think that a border tax is extremely bullish for the USD, the team at Goldman Sachs is a bit more cautious:

Here is their view, courtesy of eFXnews:

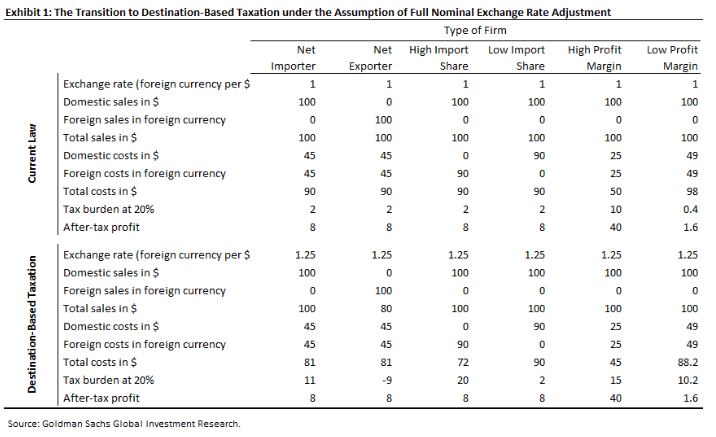

The potential switch to destination-based taxation in the US has far-reaching implications for the US Dollar. Under the current US taxation regime, goods and services are taxed based on their origin, rather than where they are sold. Under a new proposal being considered by House Republicans, taxes would be based instead on where the goods and products are sold, with a so-called “border adjustment“ that would allow firms to deduct domestic wages. This would result in a lower tax rate for firms that are net exporters and a higher tax rate for net importers

We give our initial take on the likely path for the Dollar should this switch actually occur, which we think has about a 30 percent probability. While models suggest the adjustment should be uniform across other currencies, we expect the reaction would be quite different against EM and G10 currencies given the various countervailing forces that would come into play. Whatever the merits of the proposed legislation, we think markets would treat it as an escalation of trade tensions between the US and the rest of the world.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

We therefore expect the largest net exporters – such as KRW and the RMB – to weaken substantially against the Dollar. This would probably be compounded by concerns over supply chain disruptions for firms, weighing on investor sentiment which could contribute to a risk-off environment. For the G10, previous risk-off episodes demonstrate that the market acts by rolling back expectations for Fed hikes. In February of this year for example, the market went so far as to price some probability of a rate cut.

For the Dollar against the G10, the net effect is therefore more ambiguous, but EUR and JPY should outperform EM, as in most risk-off periods.