The US dollar rallied nicely since Trump’s election and the consequent rate hike from the FED. The focus of markets is on the fiscal stimulus that the President-Elect talked about. However, there is another factor that could boost the greenback: the so-called Border Tax.

Here is their view, courtesy of eFXnews:

One of the least talked about but possibly most important tax shifts in the history of the United States is House Speaker Paul Ryan’s and President-elect Trump’s “border tax adjustment” proposal.

This is part of the “Better Way” reform package and also figures prominently in the writings of senior Trump administration officials.

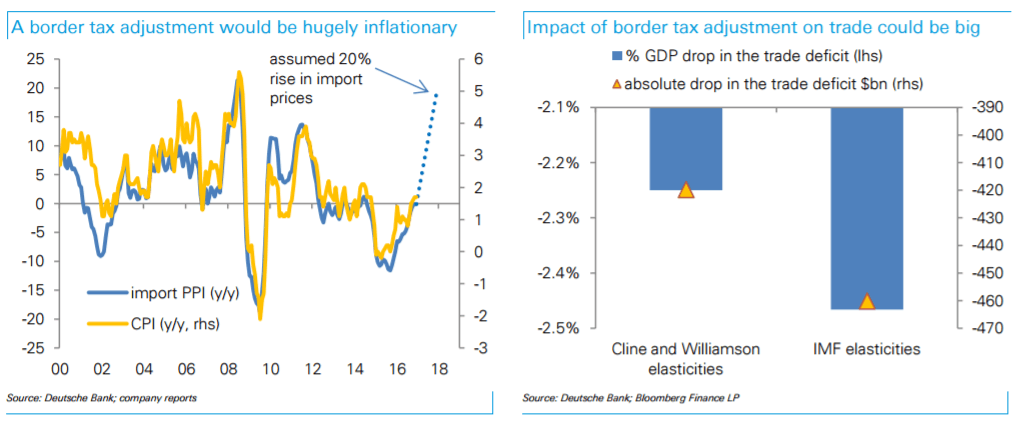

Put simply, the proposal would tax US imports at the corporate income tax rate, while exempting income earned from exports from any taxation.

The reform would closely mirror tax border adjustments in economies with consumption-based VAT tax systems.

If enacted, we believe the plan would be extremely bullish for the US dollar. What’s more, it would have a transformational impact on the US trade relationship with the rest of the world.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.