In our FED preview, we laid out three scenarios, only one USD positive. The team at Bank of America Merrill Lynch analyzes the event:

Here is their view, courtesy of eFXnews:

From 2 to 3 hikes in 2017

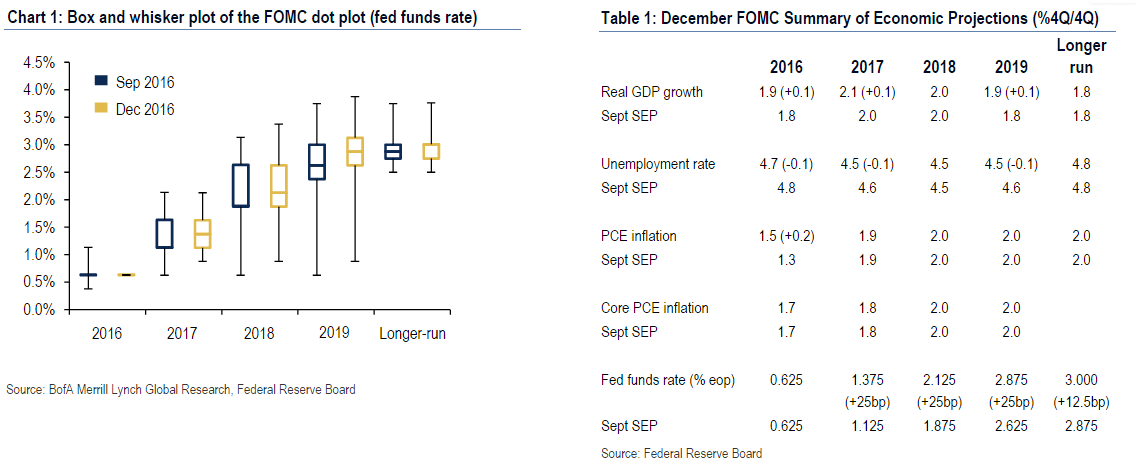

The FOMC hiked 25bp to a range of 50 – 75bp, as largely expected. The spotlight was on the dots, which shifted higher –the median forecast for 2017 fed funds increased to 1.375%, which implies three hikes for 2017. The trajectory stayed the same thereafter, assuming three hikes in 2018 and 2019, leaving the median forecast for the FF rate at 2.125% and 2.875%, respectively, for 2018 and 2019 (Chart 1and Table 1 next page). The Fed also increased the long-run expectation for the fed funds rate to 3.0%. Outside of the dots, the economic forecasts were little changed with slightly stronger growth and a slightly lower unemployment rate, which was largely a mark-to-market. The statement maintained a cautious tone, noting that the Fed will continue to monitor risks. We are holding with our forecast that the Fed will hike once in 2017 and three times in 2018, but the risks to our forecast are skewed to the upside.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

FX: Fed supports our bullish USD views

The FOMC statement confirms our view that the risks of a faster pace of Fed hikes on the back of fiscal easing will be a significant USD support in 2017. The increase in the Fed‘s dot plots to imply 3 hikes in 2017, while not directly attributable to fiscal easing, belies the upside growth risks from such policies. Indeed, as discussed above, oureconomics team now sees 2 hikes in 2017 (1 before) consistent with these risks.

Additionally, as we anticipated, the Statement and Chair Yellen did not evince any specific concerns about the recent USD rally. When asked in the press conference about the USD strength, Chair Yellen discussed broad asset price movements in terms of expectations for fiscal policy expansion. With trade-weighted USD gains since the election still relatively modest, and the Y/Y changes in the dollar flat, the USD is not the clear and present danger it was in the past 1.5 years. Also, the factors driving the Fed (namely Fed hikes and best US growth expectations) are what‘s driving the USD, not ECB/BOJ easing, so they are more able to withstand the tightening of financial conditions as a result. This leaves further room for the dollar to rise in the absence of a negative hit to growth & equity prices and/or a more permanent shift by the new administration away from the Treasury‘s long-held ‘strong dollar‘ policy.

Bottom line, the trajectory of Fed policy will remain a positive USD support heading into 2017. We do see some risk that stretched fast money positioning (and other idiosyncratic factors) could lead to some periodic USD pullbacks, but the trend remains firmly higher following today‘s meeting.