It’s always important to remember that a UK exit from the EU is also a blow to the euro. We have seen such reactions and may see them again. The team at Goldman Sachs explains the fate for the euro which may differ between the immediate reaction and the longer lasting one.

Here is their view, courtesy of eFXnews:

In the wake of last week’s tragic events, the market has increasingly positioned for the “remain” camp to prevail in tomorrow’s referendum, but in our view there remains ample room for risk premia to come off. Our preferred gauge for this is EUR/GBP, which we think should continue – based on our assessment of fundamentals to converge down towards 0.70

Today, we discuss how EUR/$ might behave in the event of a “leave” vote. Very short term, by which we mean the 24-48 hours after the vote.

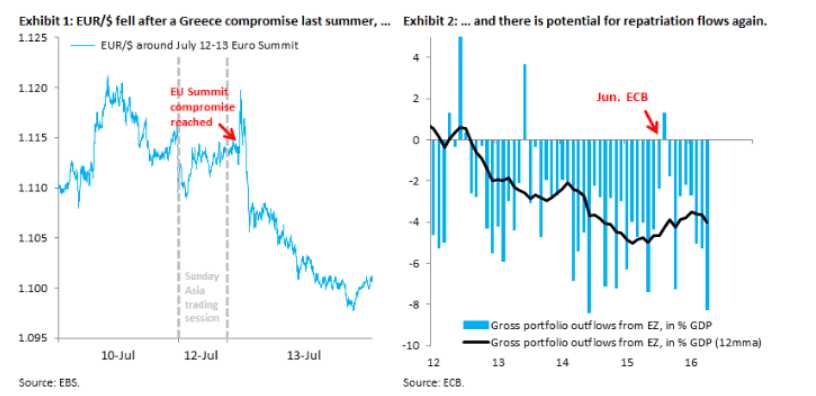

The uncertainty around Grexit last summer provides a benchmark for how EUR/$ might behave in the event that “leave” prevails tomorrow. When risk aversion spiked on mounting Grexit fears, EUR/$ rallied on safe haven flows. It was only following the EU summit on July 11-12 (which reached a compromise on Greece) that EUR/$ fell meaningfully, going below 1.10 in fairly short order (Exhibit 1).

We think similar repatriation flows could again buoy the single currency in the very short term, by which we mean the 24-48 hours immediately after “leave” prevails. There is again potential for such repatriation flows, given that gross outflows have rebounded from last summer (Exhibit 2), when President Draghi confused markets with his statement in the June press conference that markets should get used to “higher volatility”

But beyond these short-term effects, we see Brexit, should it occur, as a clear catalyst for EUR/$ down, because it would represent a negative confidence shock to a region that is struggling to reflate. We think this would allow “doves” on the ECB Governing Council to shift back into proactive mode and pursue more activist monetary easing, setting the stage for a resumption of the Euro downtrend.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.