The US dollar continues its recovery, enjoying the boost it got from Yellen. Two banks are bullish on the US dollar. They discuss the reasons and the currencies to be bullish against:

Here is their view, courtesy of eFXnews:

USD: Fundamentals Firmly Favor Dollar Up; We Stay Firmly Bulls – Goldman Sachs

A natural tendency is to examine previous episodes of Dollar over- or undershoots, with the goal of trying to estimate some ‘half-life.’ We are not big fans of that.

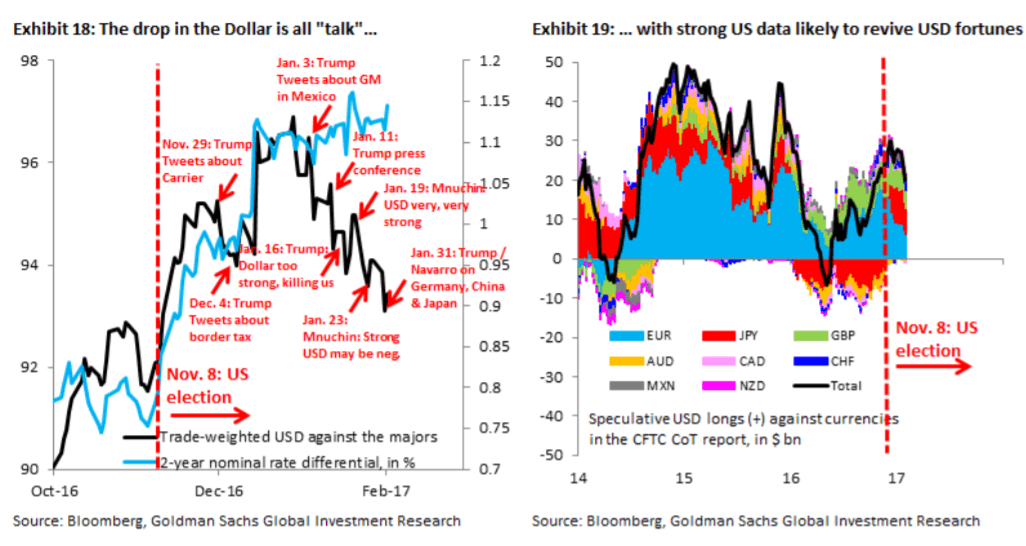

Take the undershoot from a year ago, which began with mounting China fears. The Dollar fell sharply versus the majors, while rate differentials – even with successive dovish shifts from the Fed – were relatively stable. That episode ended with the election, which lifted the 2-year rate differential firmly in favor of USD. This time around, Exhibit 18 shows that the decoupling of the Dollar coincides with the stream of communications from the new administration from early January, which has signaled discomfort with a strong Dollar. The underlying driver of this decoupling is therefore very different from the previous 2016 episode, and we doubt it holds much relevance.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

We would say two things. First, we think the ‘Dollar down’ rhetoric says more about the constraints facing President Trump, rather than likely outcomes. After all, a policy mix that combines fiscal stimulus and protectionism is hard to reconcile with a weaker currency, even if that is what the new administration wants. Second, speculative Dollar longs are more modest than they were a year ago, in particular where EUR/$ is concerned (Exhibit 19).

The fundamentals firmly favor Dollar up. The market just has to get used to the new administration and good data should help with that. The market is pricing 64bp in tightening through 2017, well below our US Economics team’s forecast of 100bp.

More importantly, through end-2019 the market is pricing about 130bp or just over five hikes. This strikes us as low and points to further upside for the Dollar, including in the near term.

We expect the USD to continue to move higher. We expect the TWI USD to appreciate about 7 percent versus G10 currencies over the next 12 months.

USD: ‘Animal Spirit’; We’re ‘Comfortable’ Staying Long Vs EUR & JPY – Morgan Stanley

Animal spirits are now often mentioned in press reports. The last time the US was experiencing animal spirits goes back to the 90s when James Rubin ran the US Treasury. Then it was the high-tech boom driving many asset classes. The stock market started to correlate with retail sales as wealth effects kicked in.

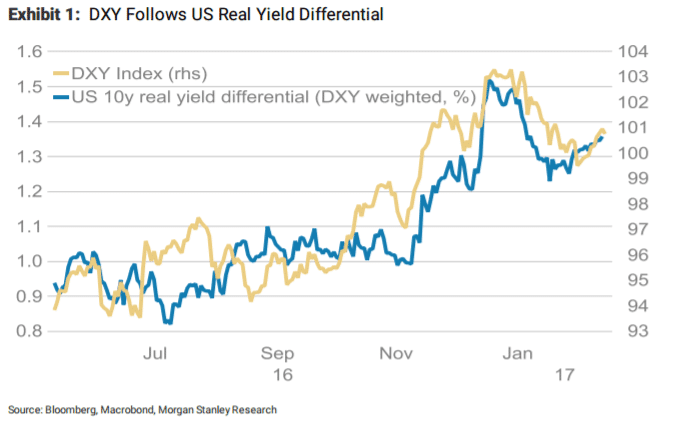

We have not yet seen this effect in the US, but with the continued asset rally the likelihood of animal spirits taking over is not insignificant. Our ARIA US growth indicator has shown a solid 0.41% rise supported by the consumer, employment, nd housing. With improving company capex plans and inflation expectations, the Fed may end up finding fewer reasons to stay dovish. Last year, it was the shaky international background pushing the USD sharply lower as the Fed eased the markets’ rate expectations via dovish talk.

Today even the global environment looks better with EMU economic and political divergence providing the exception.

We’re comfortable with our USD long positioning against low yielding currencies EUR and JPY.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.