The Canadian dollar suffered a beating due to various reasons and awaits employment number (see how trade them here). Next week, we have the decision of the Bank of Canada.

The team at Goldman Sachs sees a dovish message from the BOC and explains:

Here is their view, courtesy of eFXnews:

The decline in commodities, and in particular in oil, has helped push USD/CAD higher, and Goldman Sachs thinks the move has further to go into next week’s BoC meeting.

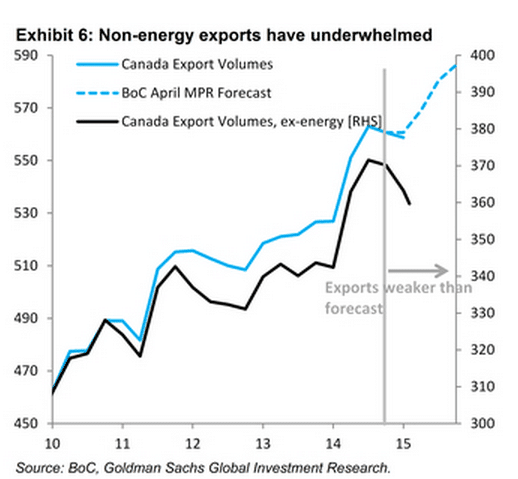

“Next week’s Bank of Canada meeting has the potential to surprise on the dovish side, adding to CAD underperformance . At the very least, the meeting should see meaningful downgrades to the BoC’s growth forecasts, following the downside surprise in the latest monthly GDP figures from April and disappointing export numbers for May,” GS projects.

“In particular, we think the BoC’s 1.8%qoq annualized forecast for Q2 is likely to fall at least as low as 0.7% – and potentially even lower. Another source of concern is the sluggish trend in non-energy exports, which has weakened recently. And the renewed decline in the oil price does not help the activity outlook,” GS adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.