The Canadian dollar jumped on Trump’s reopening of the Keystone XL pipeline option, but the enthusiasm may be too early.

Here is their view, courtesy of eFXnews:

The C$ was given a boost this week by Donald Trump’s thumbs up on the Keystone XL pipeline. However, most of the initial investment will be seen in the US. Meanwhile having the production capability to make full use of the pipeline will require further investment in the oil sands.

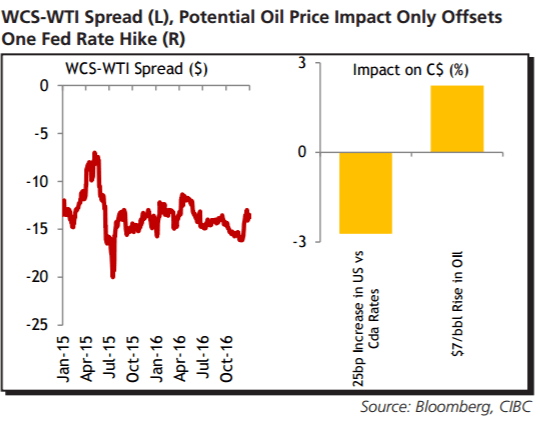

That was already due to improve slightly, but higher world oil prices would be needed to bring more significant increases. Easing bottleneck’s in getting oil to the US market should help narrow the spread between Canadian crude and WTI.

But even if the spread halved from current levels, our sensitivity analysis suggests only a 3% impact on the C$. That’s equal to only 25bp worth of change in rate spreads between the US and Canada.

As such, we still expect the loonie to be weaker by end-2017.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.