The Canadian dollar is on the back foot following the election of Donald Trump. What’s next?

Here is their view, courtesy of eFXnews:

Traders have focused on currencies other than CAD postelection night, but that could change.

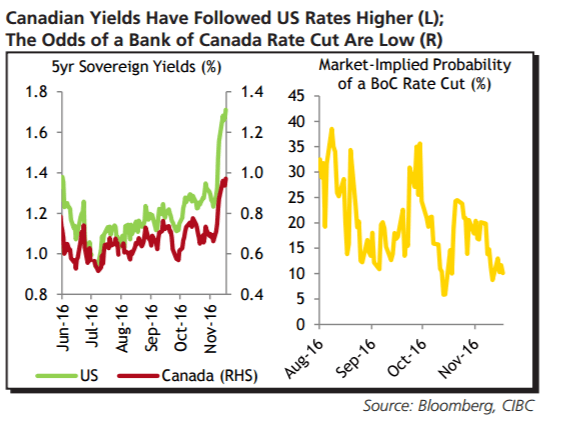

While a fully priced Fed hike won’t move the needle much in December, the BoC may have to provide a dose of verbal intervention to keep Canadian 5-year rates from following US ones too far. We don’t expect the central bank to actually pull the trigger, but markets are only pricing a 10% chance of a cut by mid-next year. That seems too low.

The election of Trump has actually increased the likelihood of Canadian economic underperformance next year, with capital spending plans possibly delayed due to US trade policy uncertainty.

Add it all up, and we expect the loonie to hit 1.39 by the end of Q1 2017.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.