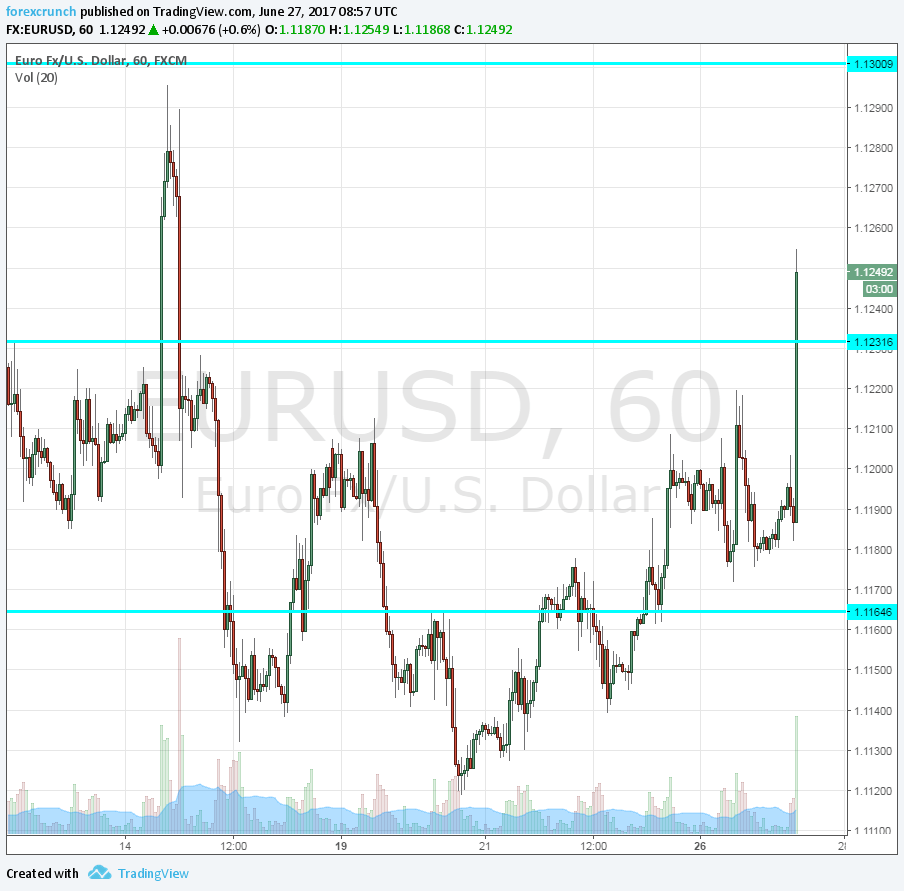

Draghi began talking about QE tapering, sending EUR/USD 70 pips to the upside and above resistance at 1.1230. After repeated attempts to break above 1.13 failed, can euro/dollar make the move? A lot depends on his counterpart on the other side of the Atlantic.

1.13 was the swing high around the US elections in November. Earlier in June, the pair pushed higher, stopping at 1.1260 and then at 1.1284. After

After US inflation dropped sharply, the pair hit a high of 1.1295. But on the same day, June 14th, the Fed raised rates, and Janet Yellen sounded optimistic about the economy.

And Yellen could hold the keys to the move: she speaks later today at 17:00 GMT. The Fed Chair could acknowledge the weakness in US inflation, thus providing a double-whammy for the pair.

Most recent US data has been weak: durable goods orders fell more than expected. Her colleagues are quite split: some are worried about low inflation while others such as Dudley are more optimistic.

EUR/USD levels

After topping the cap of 1.1230, which was resistance in the narrow range, there are no more limits until 1.13. Above 1.13, we are already at levels last seen last year: 1.1360 and 1.1420.

Should Yellen go hawkish, 1.1230 is immediate support, followed by 1.1160 and 1.11.

All in all, the 1.11 to 1.13 wide range characterizes the pair’s trading after the uptrend stalled. Is it time for a break to the upside?