EUR/USD has been stuck in a narrow range for a long time, frustrating many traders. It has become the “new USD/JPY“. However, the team at SocGen sees a future for the pair, to the upside.

Here is their view, courtesy of eFXnews:

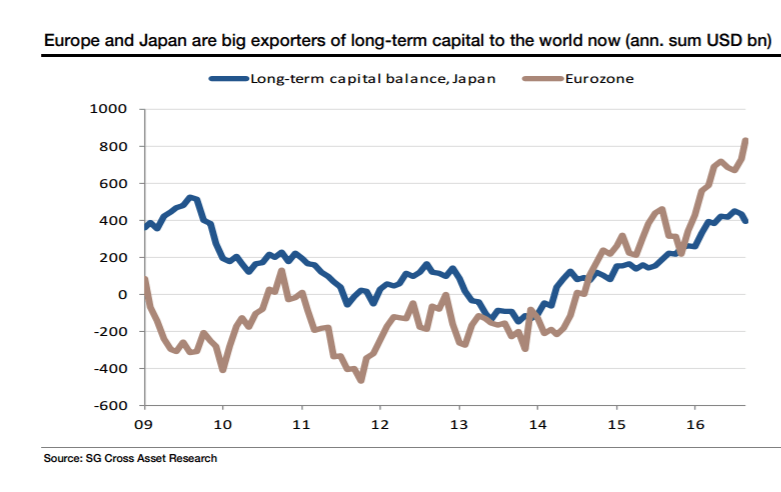

The chart below shows net annual long-term (direct and portfolio investment) capital outflows from Japan, in US dollars. The switch from net importer of capital to exporter in 2014 helped weaken the Yen and the Euro. It still provides a lot of fuel for risk assets everywhere.

But if massive capital outflows merely keep EUR/USD in a stifling range, isn’t the risk at some point in the next year, that any hiccup in those flows triggers a sharp Euro rally?

A Euro surge would catch just as many people off guard as the yen move did. The best way to position for this is to be long EUR/GBP.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.