The Bank of Canada decided to leave the interest rate unchanged at 1% as expected and seems to be in no rush to raise rates anytime soon. They talk about “caution” regarding further hikes even though other statements are relatively upbeat about the economy.

The BOC sees the economy as running close to its potential in the 2-year horizon. The output gap will near 0 in Q3 2017. However, housing spending could slow on due to various factors, including higher interest rates.

Forecasts were raised for this year and the next one as well. The slack in the labor market provides room for growth without inflation. Inflation is expected to reach 2% in the second half of 2018, later than expected. They blame that for the higher exchange rate. They also point to uncertainties from NAFTA.

All in all, the text does contain some positive notes but regarding inflation, it is quite downbeat: blaming the strength of the C$, pointing to labor market slack in relation to low inflation and the general caution are all negative for the loonie.

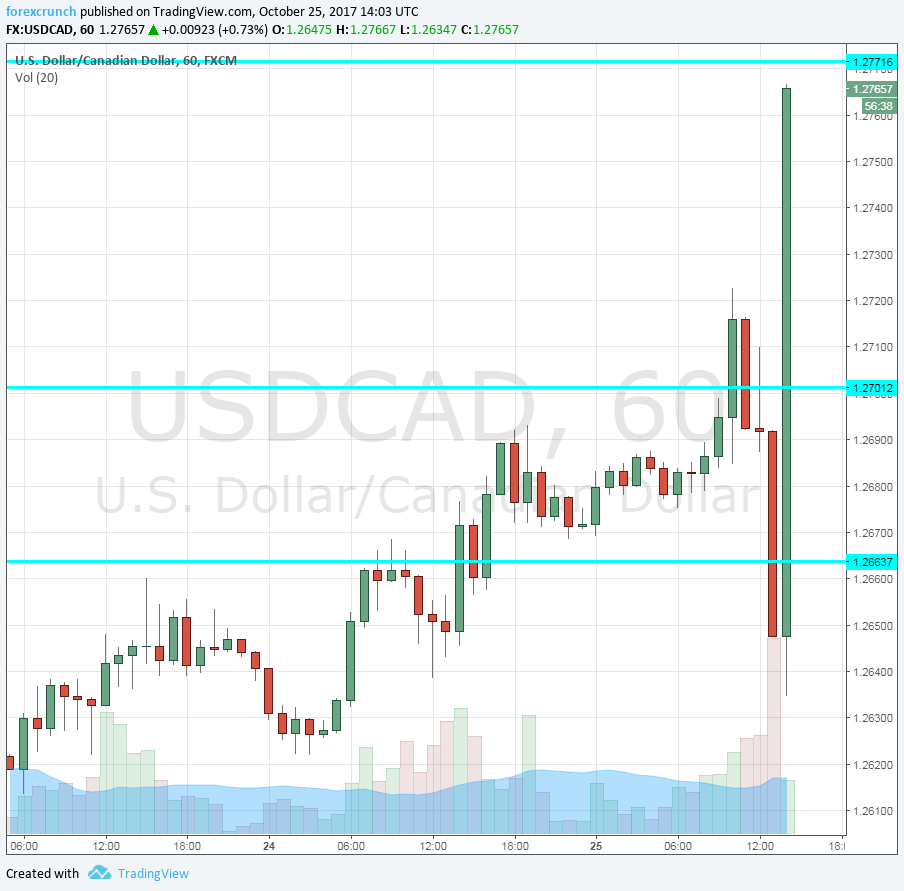

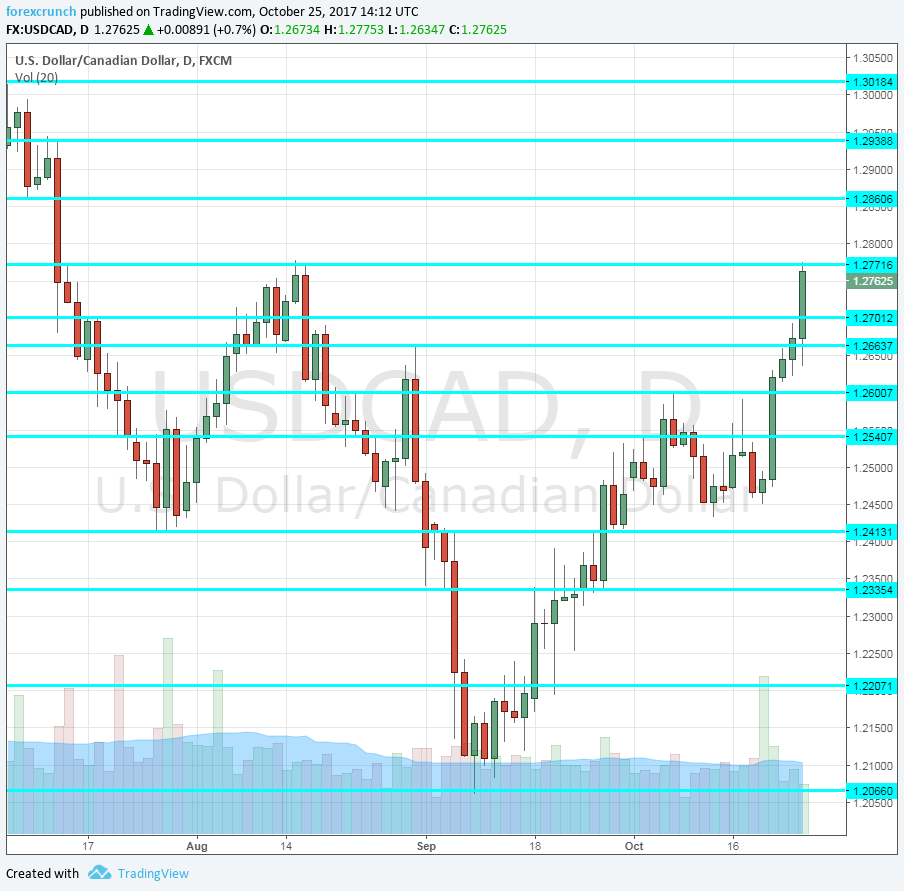

The Canadian dollar is tumbling down, with UDS/CAD breaking to 1.2740 1.2760. Resistance awaits at 1.2770, which capped the pair. Further resistance awaits at 1.2860 and 1.2940 before the round number of 1.30.

More: USD/CAD at the highest in 3 months – levels to watch

The high so far is already 1.2775, but the break above 1.2770 is not confirmed yet.

Update: the pair extended its gains and topped 1.28. Analysis: CAD: A Move To A More Dovish Stance By BoC – CIBC

Here is how the move looks on the Dollar/CAD hourly and daily charts:

At the same time, the US published the level of new home sales, and these jumped by 18.9% to 667K, giving another boost to the greenback against the loonie.

The Bank of Canada was widely expected to leave the interest rate unchanged at 1%, pausing after two consecutive rate hikes. The big uncertainty relates to the next moves: further hikes in early 2018 or a very long pause or even cessation of the short tightening cycle.

USD/CAD was trading around 1.2675 ahead of the publication. It had already broken above the resistance line of 1.12665 and reached new highs at 1.2722 earlier in the day, before reverting to just above that line.

Stephen Poloz and his team raise rates because the Canadian economy grew at an impressive pace in the first half of the year. They were expecting inflation to pick up and wanted to be ahead of the curve. Raising rates twice is basically undoing the rate cuts that the Bank decided upon in 2015. Back then, it was a reaction to crashing crude prices.

Raising rates further would already send the Overnight Rate to a level last seen in early 2009 when the financial crisis was at its peak.

More: BOC to hit the brakes? What does it mean for CAD?