Canada had its double-feature Friday and data pointed in one direction: down. In the past, the simultaneous publication of retail sales and inflation figures triggered confusion as one figure would turn positive and the other negative. Not this time.

Retail sales rose by only 0.2% instead of 0.5% expected. Core sales were up a mere 0.1% against 0.2 that was on the cards. Inflation also contributed its share to the disappointment. Year over year, prices are up 1.5% under 1.7% predicted. Core inflation came out at 1.6%.

The Canadian dollar was on the back foot throughout most of the week. USD/CAD climbed up despite some USD struggles against other currencies. The pressure on the loonie cannot be blamed on oil prices: WTI Crude Oil is up to $53.50, in the higher end of the recent range.

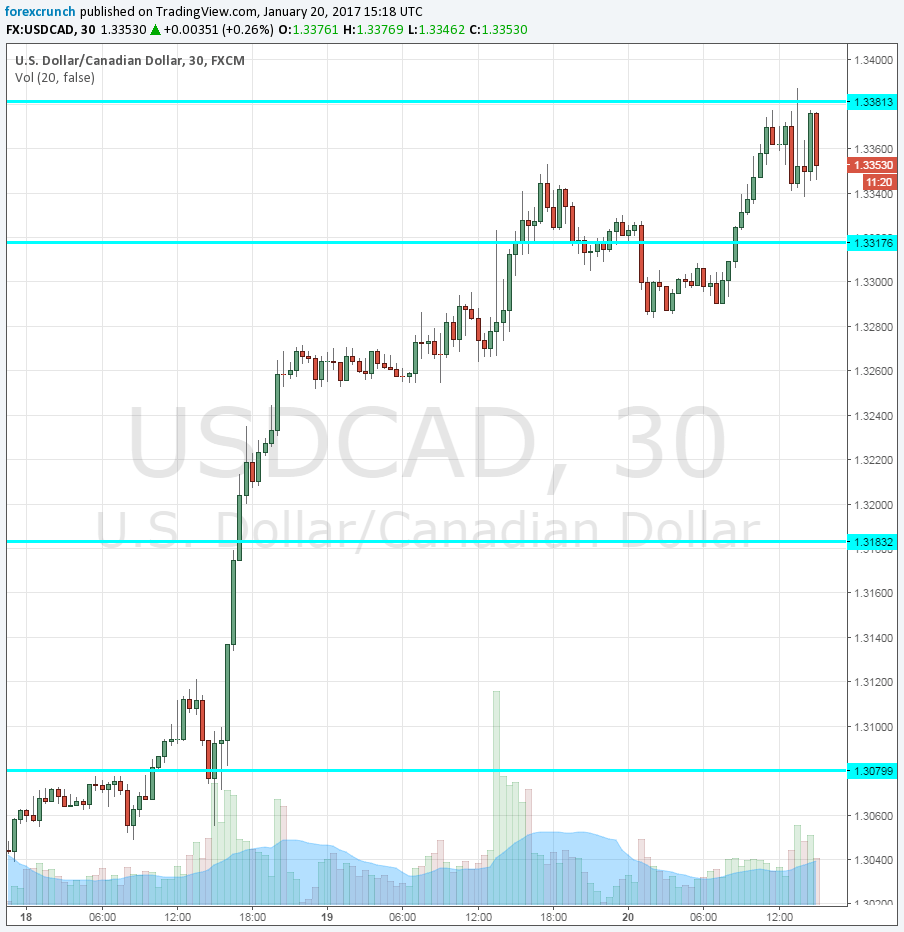

USD/CAD reached resistance at 1.3380 and now trades at 1.3350. The pair was down to the 1.30 handle but this seems like history. Support awaits at 1.3320.

More: USD/CAD: Staying Bullish & Long Post-BoC Targeting 1.37 In 2-Month – Credit Agricole

Here is the 30-minute Dollar/CAD chart: