The Bank of Canada left interest rates unchanged but USD/CAD is far from unchanged, falling to new lows.It seems that markets were expecting a dose of dovishness after the disappointing inflation data, but the BOC chooses the bright side.

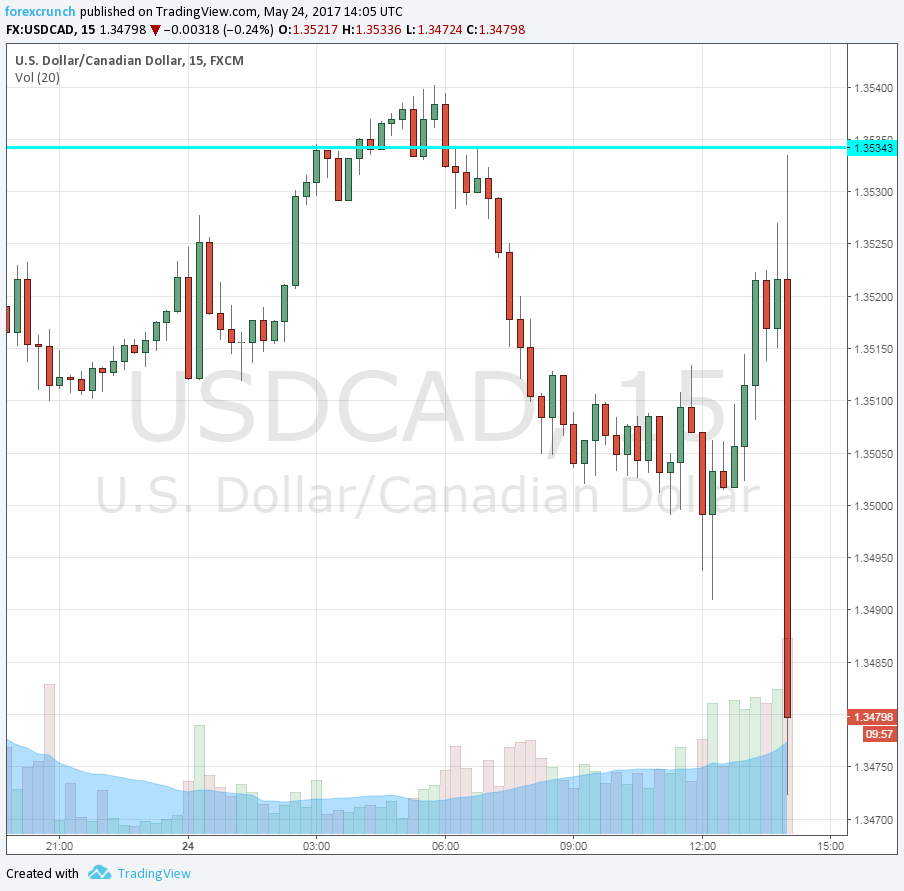

Dollar/CAD is trading just around 1.3480, falling from resistance at 1.3540. Update: the new low is 1.3444. Will the OPEC meeting tomorrow give the loonie another launch? Or will things reverse?

The BOC states that its three measures of core inflation remain below 2%. This was also evident in last week’s data. However, they see it as broadly in line with their projection.

On the brighter side, they note that recent economic data has been positive, noting the improving labor markets, the resulting enhanced consumer spending, and also a rise in business investment.

This growth was strongly expressed in Q1 and was broad based. They do see some moderation in Q2, but looking outside Canada, Stephen Poloz and his team state that the global economy is gaining traction.

USD/CAD drops over 80 pips

Here is the chart showing the downfall in USD/CAD. As time passes by, the pair is digging into the deeper ground, challenging support at 1.3460.

More: CAD: Busy 24 hours with the BOC and OPEC