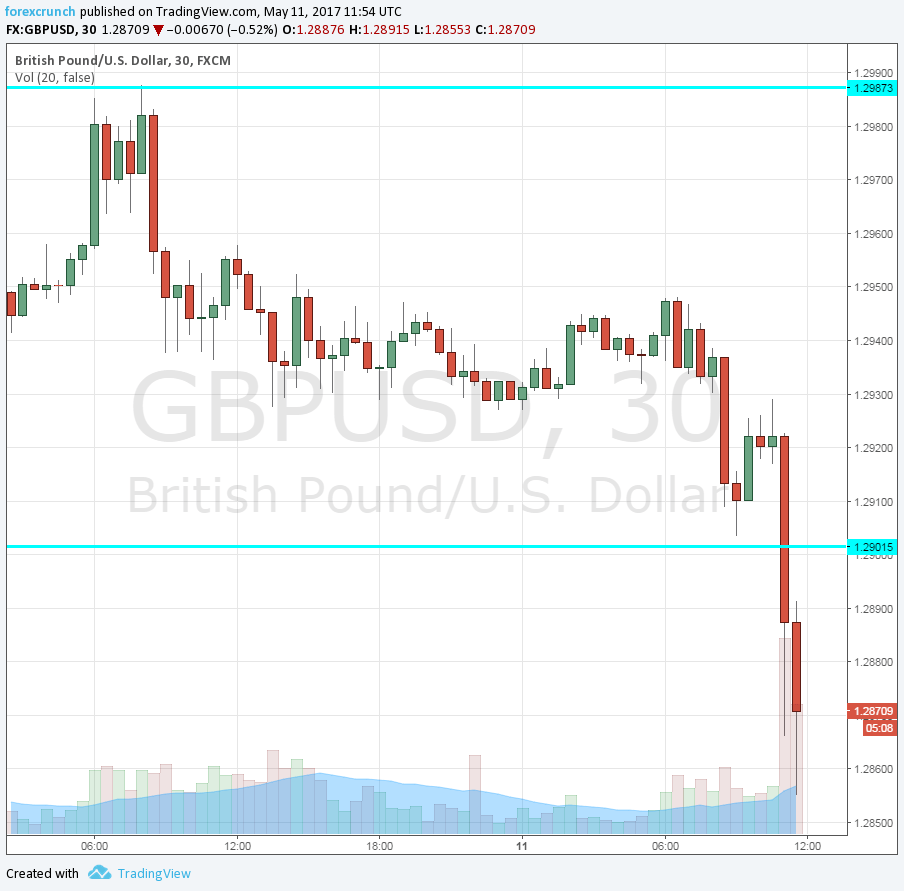

The Bank of England’s Super Thursday is super indeed. Despite worries for a muted outcome given the elections, the BOE sparks volatility. GBP/USD is falling, with every recovery attempt followed by a deeper fall. Sterling is also on the back foot against other currencies.

They did try to keep things balanced, but there are a few worrying things that come out. Here are three factors weighing on the pound.

- Assuming a soft Brexit: The BOE may be trying to overcompensate for gloomy forecasts before the EU Referendum. They assume a smooth Brexit process and a transition period. Given the very vocal clashes between May and Juncker, and the general tough tone coming from both side, it is hard to justify this assumption. A hard Brexit looks real. If forecasts are based on hope, markets are not buying it. Carney also mentioned that the BOE hasn’t modeled for a disorderly Brexit. Aren’t they remiss not to prepare for all the contingencies?

- Inflation is peaking: The meeting minutes do contain some wording about a steeper yield curve and a tighter path of rates, the Bank does see inflation peaking at 2.82% by Q4 2017. If inflation does not even meet the edge of the 1-3% range as mandated by the government, there is no justification for a rate hike. Not now, nor in 2018.

- Negative wage growth: The reporters are asking about the squeeze on British households. With inflation at 2.3% and wage rises at 2.3%, standards of living are falling. Carney exacerbates worries by talking about negative wage growth this year. He did try to correct the notion by mentioning a brighter future, but the hard data for the past and expectations for the future look grim.

Those were the reasons for the fall of the pound. And here are reasons why it could continue falling in the next few days.

- Top-tier hard data next week: Next week we’ll get three key figures: inflation, employment, and retail sales. Does Carney know something we do not know? Even if the BOE does not have the data so early, there are good reasons to believe that it will be less than satisfactory. Wage growth is not going anywhere fast. At the current rate of 2.3%, it is hard to see wages bouncing back to around 3%. The rise of the pound is still not strong enough to dampen inflation. If we look across the channel, euro-zone inflation has been high in April (perhaps due to Easter) and this could be repeated in the UK. Real wage growth could remain around 0%. And regarding retail sales, early estimates by the BRC point to more buying of essentials and fewer non-essentials. So, even if headline retail sales rise, core sales could remain depressed.

- Weak growth: The UK economy grew by only 0.3% in Q1 according to the initial estimate. Revisions are quite modest in the UK. The confirmation of low growth later in the month could hurt the pound.

- The end of the short squeeze: The recent rise in the pound was triggered by the announcement about the UK elections on June 8th. However, the rise was amplified by a squeeze of shorts. Speculation is more balanced now, so flows are unlikely to trigger big bounces from the lows.

More: GBP: Has it gone too far? 3 opinions

In any case, here is the pound/dollar chart: