China reported a very big rebound in exports: 11.5% against 2.5% expected and after a big fall of 25.4% in February. Also exports look much healthier with a fall of 7.6% instead of 10.2% predicted and 13.8% last time. The Chinese New Year celebrations held in February are to blame for the worrying fall in exports in February.

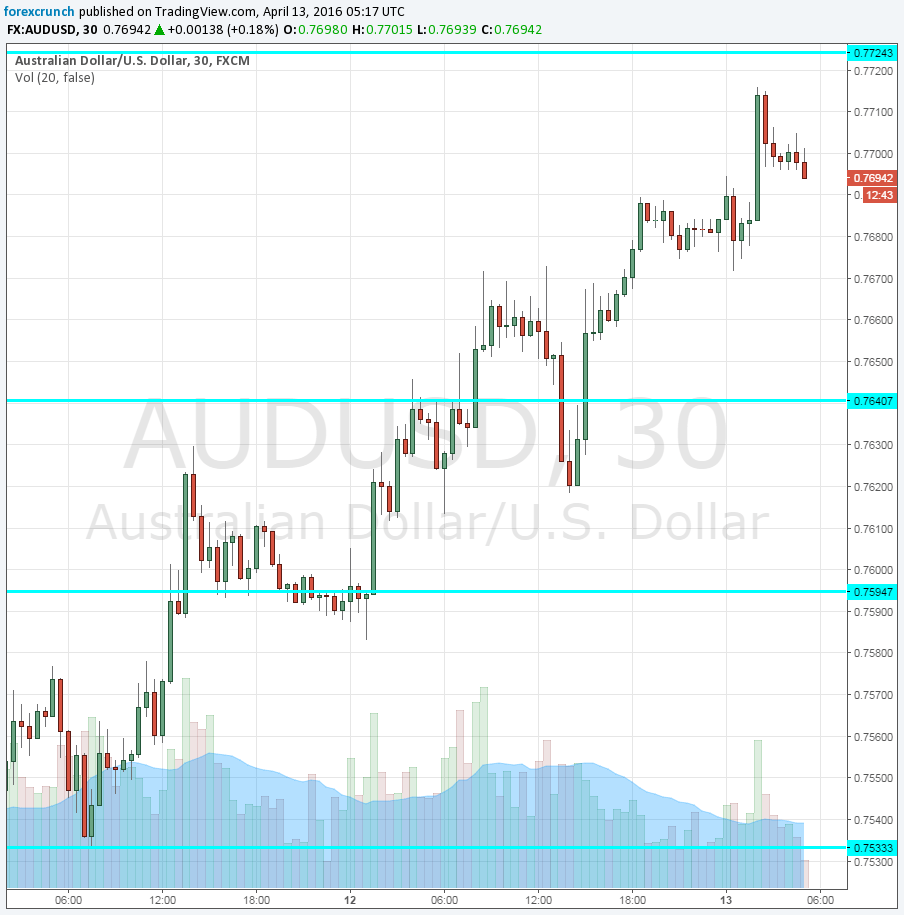

AUD/USD reacted positively with a move above 0.77 and the ripple effect was seen in other financial instruments.

However, looking slightly deeper into the data, some doubts arise: the big leap is a year over year one, and coming from a low base in March 2016. This comment comes from a customs spokesman. Neverthereless, the shift from such a big drop to such a big rise is encouraging.

The bottom line for the trade balance figure was 194.6 billion yuan and 29.86 billion USD. In recent months, the size of the surplus has moved to the back-burner and isn’t as important as it used to be.

Here is the AUD/USD chart. The Australian dollar was already rising thanks to the “risk on” mood that helped all commodity currencies, but this gave the pair another boost. The high so far has been 0.7716, shy of the 0.7725 high seen recently (the top line on the graph).

Also NZD/USD is higher with 0.6934 at the time of writing. This is also an extension of the previous move to the upside. Resistance awaits at 0.6980. USD/CAD is digging lower and trades at 1.2775.

Stock markets in Asia are on the rise and this has a positive effect on USD/JPY, which is on the move. This is clearly a “risk on” move.

Later this week, we’ll get China’s GDP figures for Q1 2016 and more specifically for Australia, the employment data is up in the upcoming Australian morning.