- Cryptocurrencies weathered news that could have been detrimental.

- This is a bullish sign, but the various coins face various technical caps.

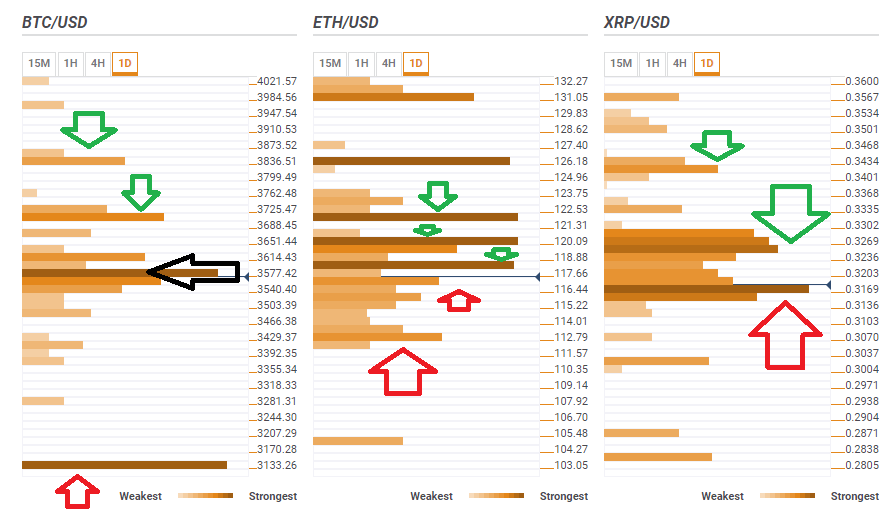

- Here are the levels to watch according to the Confluence Detector.

The Chicago Board Options Exchange (CBOE) surprised by withdrawing a rule change with the Securities and Exchange Commission (SEC) that would allow an Exchange Traded Fund (ETF) on Bitcoin. The CBOE-owned BZX withdrew a request that was also backed by VanEck and SolidX.

Crypto markets were obsessed with the potential approval of a crypto ETF and prices fell when the SEC rejected applications or postponed decisions. The motive for the withdrawal was the ongoing government shutdown as the deadline approaches. A CBOE spokesperson said the CBOE plans to resubmit the request at a later date.

The delay did not have a detrimental effect on cryptos, which initially dropped, but held onto the familiar ranges.

Something that cannot fall on bad news should rise on good news.

The good news is awaited, but the resilience is an encouraging sign. However, technical levels show a more complicated picture for digital assets.

BTC/USD battles $3,577

Bitcoin, is trading around the critical cluster of $3,577, an area which includes the following technical lines: the Fibonacci 38.2% one-month, the SMA 200’15m, the SMA 50’1h, the previous 4h-high, the Fibonacci 38.2% one-week, the B 1h’Upper, and the SMA 5’one-day.

Recapturing this critical level opens the door to $3,700 where we see the SMA 50-one-day, the PP one-day R3, the BB one-day Mieel, and more.

The next level to watch is $3,850 where the PP one-week R2 and the Fibonacci 61.8% one-month converge.

Looking down, BTC/USD has significant support only at $3,133 which is the convergence of the PP one-month S1, last year’s low and last month’s low.

ETH/USD faces fierce resistance

Ethereum is in a precarious situation. It faces immediate resistance at around $118 which is the confluence of the BB 4h-Middle, the previous 4h-high, the SMA 10-4h, the SMA 100-1h, the SMA 200-15m, and the SMA 50-1h.

Another resistance line awaits at $120 where we see the PP one-day R1, the SMA 50-one-day, and the BB 4h-Upper converge.

Further above, $122 serves as the next critical barrier. We find the SMA 10-1d, the Fibonacci 38.2% one-week, and the Pivot Point one-day R2 in this juncture.

Support for ETH/USD t is weaker, but close by at $117 there is a minefield including the SMA 5-1h, the SMA 50-15m, the SM 5-15m, the SMA 5-4h, the BB 1h-Middle, the Fibonacci 23.6% one-day, and more.

Lower, at $112, we see the convergence of the PP one-week S3 and the PP one-week S2.

All in all, Vitalik Buterin’s brainchild looks stable despite the delay of the Constantinople upgrade, but the technical picture is dark.

XRP/USD at crossroads between support and resistance.

Ripple enjoys considerable support at $0.3169. The dense cluster includes last week’s low, the SMA 10-1h, the SMA 50-15m, the BB 15min-Middle, the SMA 5-1h, the SMA 10-15m, the SMA 5-4h, the BB 1h-Middle, the PP one-month S1, the PP one-day S1, and more.

However, resistance for XRP/USD is fierce as well: at $0.3250 we see the meeting point of the Fibonacci 23.6% one-month, the BB 4h-Upper, the SMA 50-4h, the SMA 200-1h, the PP one-day R2, the Fibonacci 38.2% one-week, and the SMA 10-1d.

The next target for the third cryptocurrency in terms of market capitalization is at $0.3420 where the SMA 50-one-day and the Pivot Point one-week R1 converge.