What’s next for the US dollar after the dovish Fed? At HSBC, they see the beginning of the end of the USD rally.

But here, Goldman Sachs say that EUR/UDS shorts are still attractive:

Here is their view, courtesy of eFXnews:

Last week, Goldman Sachs reiterated the case for further EUR/USD downside, lowering its 12-month forecast to 0.95. In a recent note this week, GS maintains this view arguing that short EUR/USD structures are still attractive at current levels despite the increases in volatility.

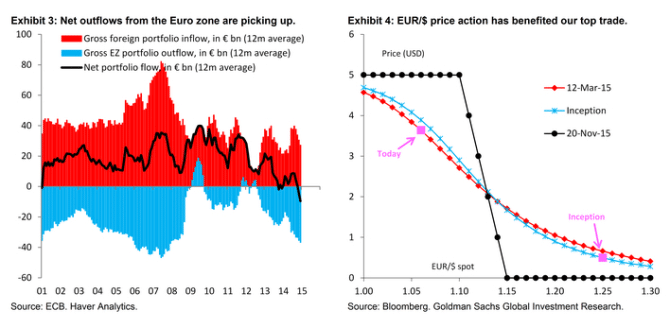

“We expect the Fed to continue along a path towards normalisation, underpinning our USD bullish view. Against this, easy policy from the ECB and low rates in the Euro area should keep the EUR weak. In particular, we think portfolio outflows from the Euro area are likely to intensify, even as the Euro area economy cyclically bounces back,” GS argues.

“Beyond the near-term improvement in the data, we continue to think that the large amount of slack in the Euro area periphery will keep monetary policy easy and reinforce the EUR/USD downtrend,” GS projects.

To emphasize the conviction in this view, GS continue to recommend being short EUR/USD, implemented via a 1.00 – 0.95 put spread expiring on 20 November 2015.

“Despite the increases in volatility, we are still of the view that the EUR/USD downtrend offers good risk-reward for short positions. From current levels, a 12-month 1.00 – 0.95 put spread offers more than a 4x maximum potential gain on our base-case forecast of 0.95 in 12 months,” GS advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.