US Treasury Secretary Steven Mnuchin says that a weaker dollar is ¨good for the US”. This is very different from the “strong dollar policy” that his predecessors from both parties traditionally had over many decades.

The US dollar is falling against all currencies, extending the losses across the board.

Mnuchin is speaking in Davos, Switzerland. He was also encouraged by the market acceptance of the tax reform and dismissed worries about China’s buying of US Treasuries.His comment about the weak dollar certainly has an impact:

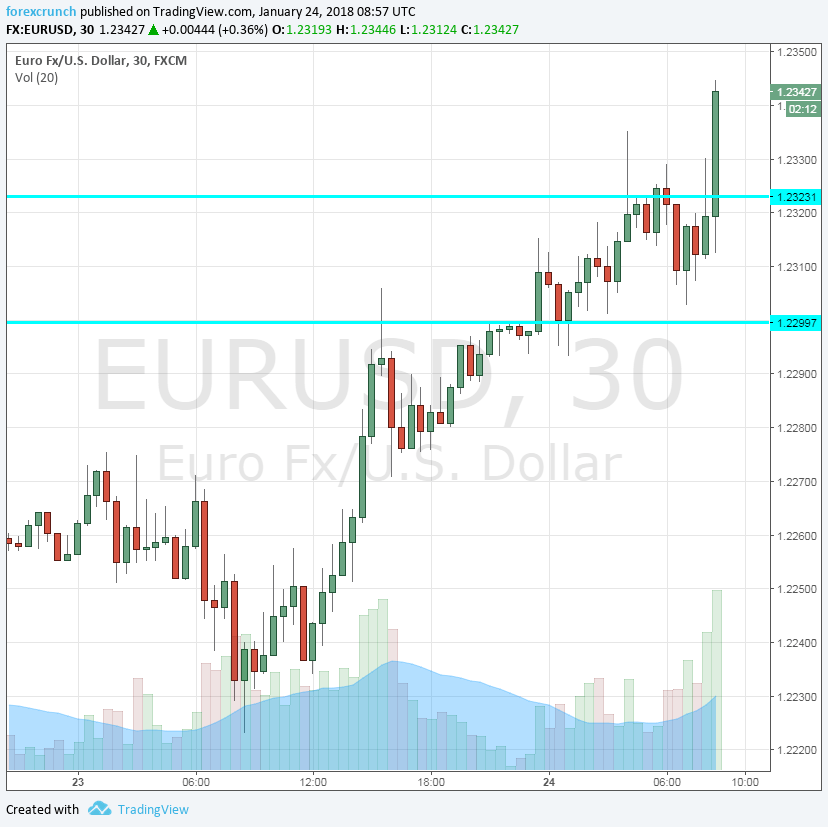

- EUR/USD jumped to 1.2344. It was already higher on the day, challenging last week’s 1.2323 high but retreating amid mixed German PMIs and ahead of the ECB.

- USD/JPY, which had already fallen under 110, extended the drop and reached a new low of 109.64. More: Steven Slide: USD/JPY deep dives under 110 thanks to Mnuchin.

- GBP/USD, which struggled to conquer 1.40, eventually made it and settled under 1.4050. Mnuchin sent it to 1.4091. We will soon get the UK

- USD/CAD, which hesitated because of NAFTA, is now under 1.24. Support is at 1.2335.

- AUD/USD, which had its own hesitation around 0.80 is trading at 0.8040. The Aussie has many reasons to rise. Here is an update: AUD/USD breaks another resistance level thanks to Mnuchin

Here is how things look on the EUR/USD chart. It seems like the only way is up for the pair, which is down for the dollar.

The greenback was able to ignore the government shutdown but if teh US government pursues a weaker exchange rate, a clear change from the past, the dollar reacts.