USD/JPY was already under pressure on the US dollar’s ongoing weakness since late in 2017. The greenback came under fresh pressure as US President Trump slapped tariffs on solar panels and washing machines. The prospects of a trade war, joining on the worries about NAFTA, weighed.

During the Tokyo session, the pair slipped under 110, an important psychological level.

And the most recent blow to the dollar comes from a direct reference to the currency. US Treasury Secretary Steven Mnuchin said that a weak dollar is good for the US. This is very different from his predecessors that talked about a strong dollar.

Dollar/yen which frequently provides the best reflection of US dollar strength or weakness reacted with a dive to 109.39 before stabilizing.

USD/JPY lower levels

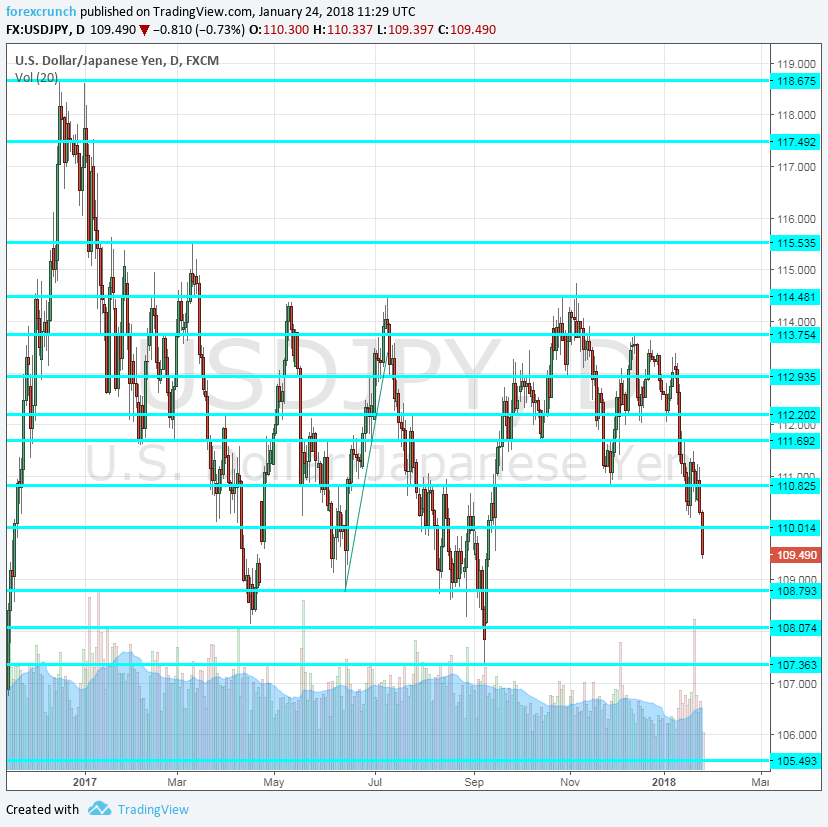

The next level of support is 108.80, which provided support to the pair in June and later in August, working as a double bottom. The next level of support is 108.10, which goes back to late April, defining the wide range.

Lower, we find the swing low of 107.35 that was seen in September. The bounce resulted in a rise nearly to 115. Below this level, we are back to levels last seen in November 2016, when Trump was elected. 105 is a round number that should be watched.

More: USD/JPY extends its falls – Forecast Jan. 22-26 2018