While some expect the weakness of the USD to continue, the team at Goldman Sachs has different views for the greenback.

Here is their view, courtesy of eFXnews:

We believe the current level of anxiety over the Dollar is overdone for two reasons.

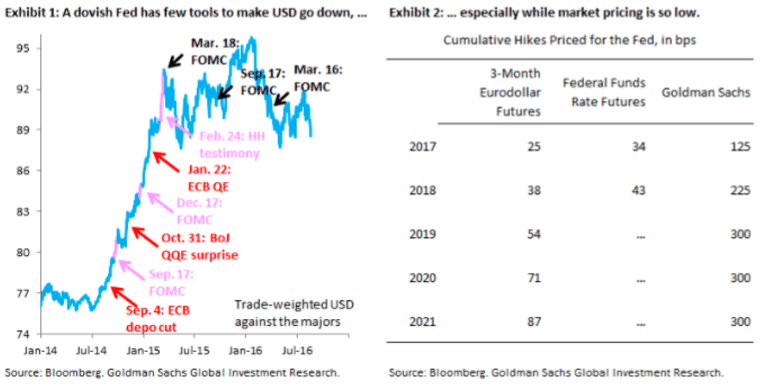

First, Exhibit 1 shows the path of trade-weighted USD versus the majors since 2014. The red arrows show the role that ECB and BoJ easing played in driving the Dollar higher, while the pink arrows show the limited role that Fed policy shifts played (the Fed dropped forward guidance in late 2014, giving USD some lift). In short, the Dollar is where it is not because of the Fed, but as a result of shifts in policy from the BoJ and ECB. Of course, the Dollar could reverse its 2014 gains, but this would require the ECB and BoJ to wind back stimulus. We forecast the opposite in the case of both central banks. The Dollar could also reverse its 2014 gains if the Fed were to embrace outright easing. But again, we forecast the opposite, with our US economists anticipating a hiking cycle of 300 bps from here through end-2019.

The second reason not to get caught up in Dollar bearishness is that rates markets at this point price very little in the way of Fed tightening over the medium term. Exhibit 2 shows what 3-month interest rate futures (first column), Fed funds futures (middle column) and our US economics team forecast for cumulative hikes from the Fed through 2021. Even a proponent of low R-Star like NY Fed President Dudley put the degree of monetary policy accommodation around one percentage point as recently as two weeks ago. It is notable that 3-month interest rate futures price less than that 5 years out!

In short, given how little the market is pricing for Fed tightening over the medium term – and it is the medium-term rate outlook that matters for our Dollar view – there is little scope to expect meaningful downside for the Dollar from here.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.