The US dollar is on the back foot during this month and there may be more in store. The euro and the yen may benefit from this and due to a reason not usually cited.

Here is their view, courtesy of eFXnews:

The higher LIBOR rate did not provide USD support, unlike other times when there have been relative rises in US private sector funding costs. There are a number of reasons:

First, the regulation driven LIBOR increase tightens US financial conditions, which at the margin may prevent the Fed from hiking soon.

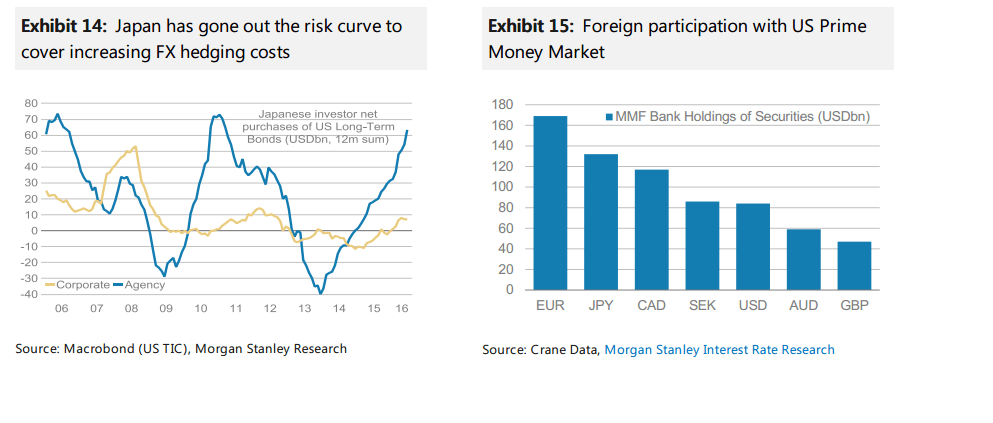

Second, the LIBOR-driven rise of hedging costs has not led to an increase in currency-unhedged purchases of USD-denominated assets.Exhibit 14 shows Japanese investors have extended the maturity curve, picking up additional yield to pay for higher hedging costs. Indeed, Japan’s investors went into JPY strength starting in December 2015 with their highest FX exposure ever.This exposure produced losses and balance sheet constraints thereafter.

Third, Japan’s private sector has funded foreign activities via US prime money market instruments. (Exhibit 15). Now as funding costs increase, foreign activities may become less lucrative, and there may be repatriation flows.

Fourth, with the introduction of new regulation, institutions with prime asset exposure face liquidation pressure, as they grow concerned about restricted access to these assets during times of stress reducing their balance sheet flexibility. Exhibit 14 shows foreign participation in the US Prime Money Market, identifying the EUR and JPY as potentially best positioned for gains.

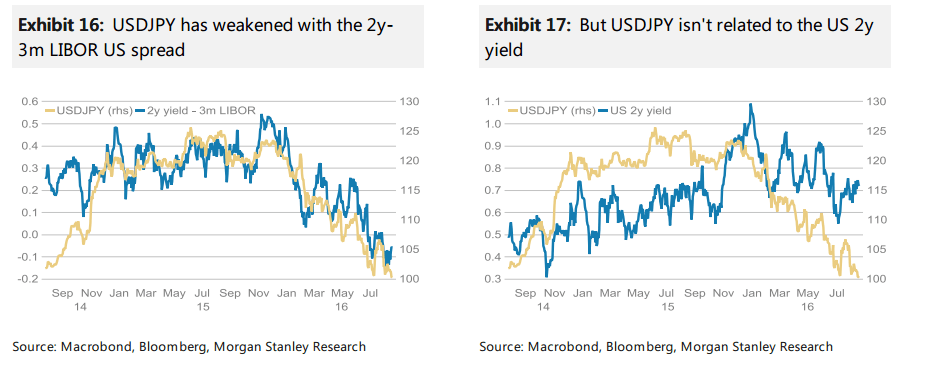

…another reason to drive EUR and JPY higher. Exhibit 16 shows USDJPY trading in response to the spread between 2y Treasury yields and the 3m USD LIBOR rate, while Exhibit 17 shows that the once close relationship between 2y yields and the performance of USDJPY has eased. The rising USDJPY response to spread between 2y yields and the 3m LIBOR rate is a function of rising funding costs indicating potential JPY-supportive repatriation flows. Since EMU funding and asset exposure into US Prime Money Market funds is even bigger, we expect US money market regulation to add to EUR buying interest.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.