- The Dollar Index drops after weaker than expected US data.

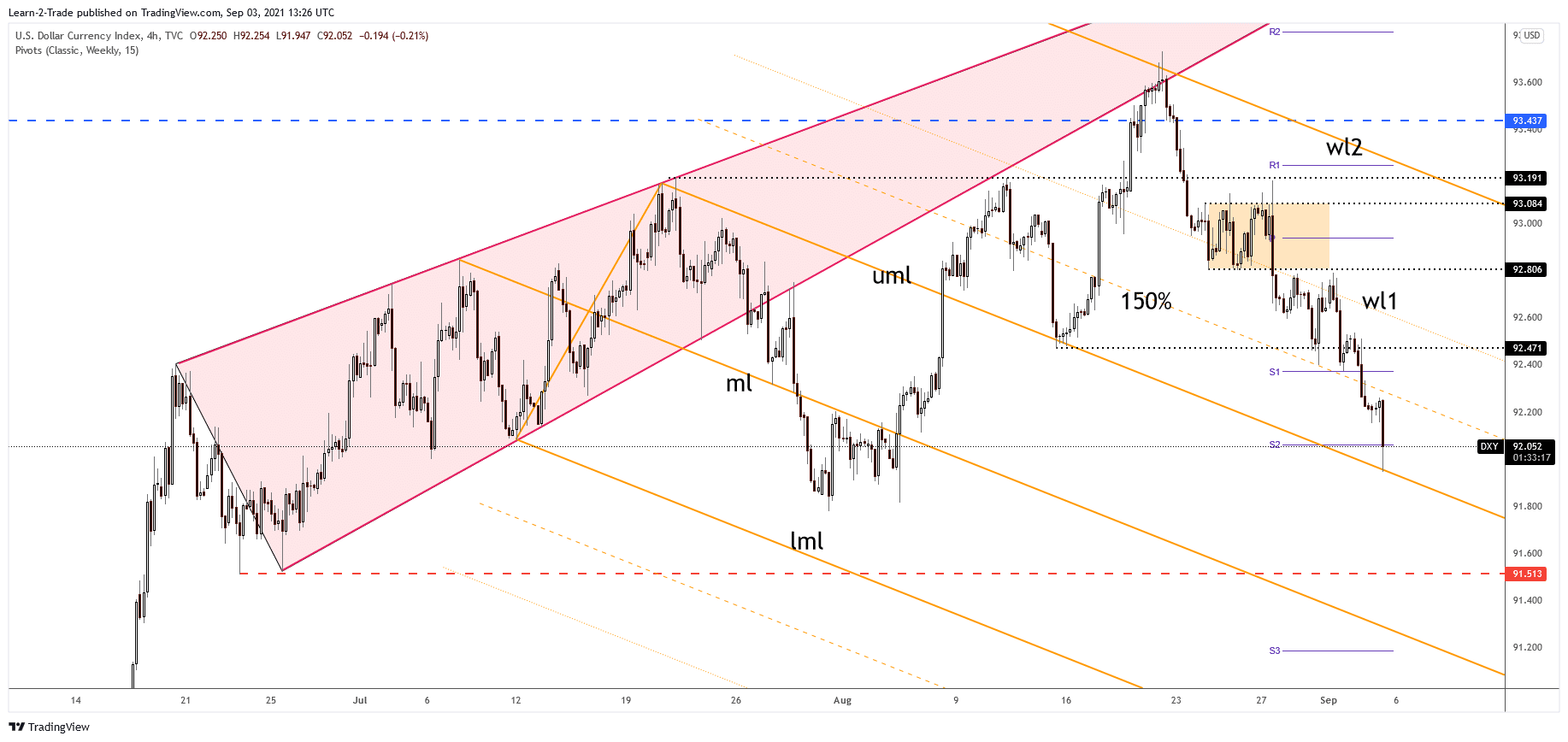

- The bias remains bearish as long as it stays under the 150% Fibonacci line.

- DXY has rebounded, but this could be only a temporary recovery before dropping deeper.

The DXY Dollar Index price extended its sell-off after the US data release. Now, the index is located at 92.12 level above 91.94 today’s low. It’s fighting hard to rebound after its massive drop.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

As you already know, the Nonfarm Payrolls indicator was reported worse than expected at 235K in August compared to 720K expected and versus 1053K in July. In addition, the Final Services PMI dropped from 55.2 to 55.1 points, even if the specialists have expected the indicator to remain steady at 55.2 points.

The DXY has recovered a little, but it remains to see how it will react as the ISM Services PMI dropped unexpectedly lower, from 64.1 points to 61.7 points below 61.9 expected. But, again, the volatility is high, so you should stay away until the markets calm down a little after these high-impact data.

DXY has only because the US Unemployment Rate dropped from 5.4% to 5.2% as expected, while the Average Hourly Earnings indicator has increased by 0.6%, exceeding the 0.3% estimate.

Technically, the bias is bullish in the short term after failing to stabilize above 93.43 higher high. Further, the drop signals USD’s depreciation versus its rivals.

Dollar Index price technical analysis: Key dynamic support

The DXY price has found support below the weekly S2 (92.06) right on the descending pitchfork’s upper median line (UML). However, the rebound could be only a temporary one. The pressure is high, so the index could drop anytime. USD could lose more ground versus the other major currencies if the index slips lower.

–Are you interested to learn more about forex signals? Check our detailed guide-

From the technical point of view, the upper median line (UML) was seen as a dynamic support. 91.78 and 91.51 are seen as downside targets as well if the DXY resumes its downside movement. The Dollar Index moves up and down very quickly in the short term. The battle between bulls and bears intensified after the US data dump. You should know that the bias remains bearish if it stays below the 150% Fibonacci line. Making a new lower low could activate a larger downside movement.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.