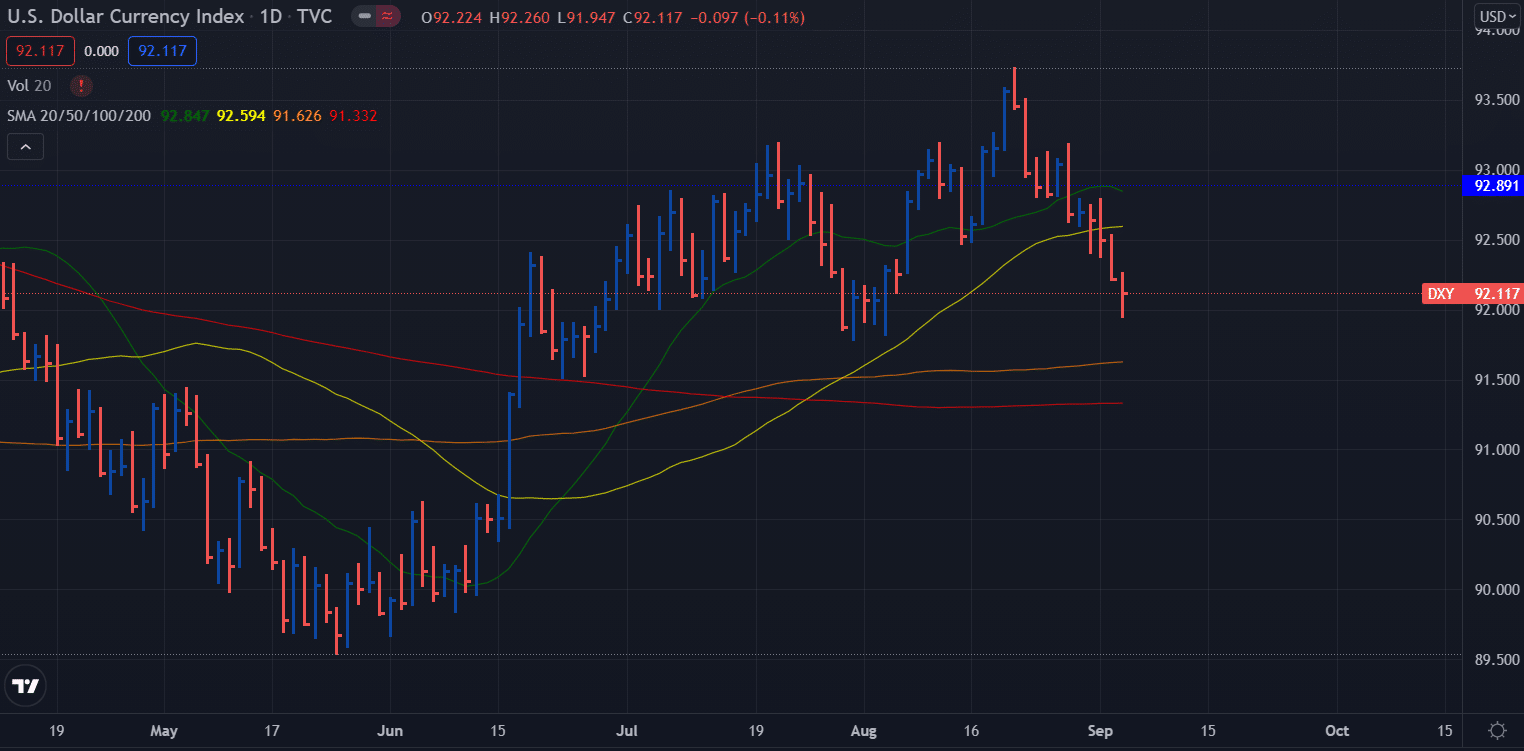

- DXY Dollar index extended losses to 92.00.

- Dismal US NFP weighed on the index and kept the pressure.

- Fed’s tapering plan and delta variant spread in the US may continue to guide the index.

The weekly forecast for the DXY Dollar Index is bearish and may aim for 91.50. However, a technical upside retracement can be seen too.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The DXY remains broadly in a bearish trend around the 92.00 area as the week ended. If another surge in the Delta variant is seen in the US, it may dampen the Greenback across the board. However, in the absence of any key data event, the risk jitters and COVID-19 related headlines will be the key to lead the price action in the index.

The US dollar index (DXY) fell around 92.00 on Friday due to selling pressure around the dollar.

The US dollar index remains low, around 92.00

After the number of nonfarm jobs fell unexpectedly in August, the index returned to its downtrend and briefly approached the 92.00 level on Friday. Despite the market consensus of 750,000 jobs being created, the US economy created 235,000 jobs last month. In addition, the number of jobs increased to 1,053 million in July (up from 943k in June).

Despite the decrease in the unemployment rate, the average hourly wage increased 0.6% between months and 4.3% annually, exceeding previous estimates in both instances. While participation stayed at 61.7%, it remained unchanged from the last year.

Contrary to the DXY pullback, the 10-year benchmark yields have rebounded to 1.33%, having broken above the daily consolidation topic around 1.30%.

The Fed will likely not announce its asset purchase tapering plan at its meeting in September, which means market participants will probably report it in November or December.

Delta Variant in the US

There was an average of 163,600 Coronavirus cases per day in the United States over the past week, increasing 12 percent from two weeks ago. A total of 40 million cases is likely to be reported within days.

More Coronavirus cases were reported in Oregon, Kentucky, and Guam in the past week than in any other seven-day period. In addition, the past week has been the deadliest for Coronavirus in Florida.

A total of 101,500 patients have been hospitalized with Coronavirus, with more than 15,500 admitted to Florida hospitals, where hospital admissions are much higher than anywhere else in the country.

On Monday, Kentucky’s unemployment rate was at its highest level in a year.

Key events from the US during Sep 06 – 10

The important events include the JOLTS job opening due on Wednesday ahead of Fed William’s speech in the US. Moreover, weekly unemployment claims are also significant to note. Other than that, US PPI m/m data may also trigger volatility due on Friday. The figure is expected to slide to 0.6% against the previous month’s reading at 1.0%.

–Are you interested to learn more about forex signals? Check our detailed guide-

DXY Dollar Index Weekly technical forecast: Probability of upside retracement

The DXY price has been dropping since August 20 (9-month top) and seems to take a pause near the 92.00 area. The Friday’s down bar closed in the middle shows the probability of an upside retracement. However, the 50 and 20 DMAs are pointing down, and the index may likely test the 100 and 200 DMAs in the 91.30 – 50 zone.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.