The focus today and main risk for volatility comes from the ECB press conference, with only limited chance of a change in policy seen today. Since the last cut in rates two months ago, we’ve seen short-term market interest rates rise, meaning that the effect on households and businesses will ultimately be very limited. This was also the case back in May last year when rates were previously cut. That does not mean that the ECB should continue pushing on a string today by cutting rates though and that would likely meet stiff opposition from within the ECB itself (as did the November easing). The ECB President is likely to underline the options available to the ECB from here, which could initially weigh on the euro, but the issue is that the effectiveness of the options is severely limited, which means that the downside on the euro could be limited further out.

Follow a live blog of Mario Draghi’s press conference.

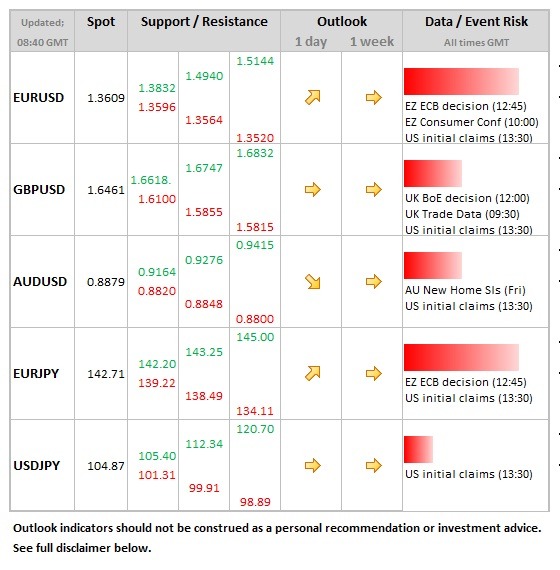

Data/Event Risks

EUR: The ECB decision falls at 12:45 GMT, with the press conference at 13:30. There have been some thoughts that a further policy move may be seen, but risks to this are low. For the single currency, the greater risk volatility comes from the press conference and comments from the President.

GBP: Bank of England decision at 12:00 GMT but little risk of change in policy or statement is seen, so sterling should be relatively restrained as a result.

Latest FX News

EUR: Once again the single currency was feeling heavy yesterday, this also notable against sterling where the early December lows on EURGBP were broken yesterday. Some recovery back above the 1.3600 level has been seen during the Asian session.

AUD: Data overnight showing retail sales firmer at 0.7% MoM, contrasted by a further fall in building approvals. The Aussie has been a little directionless so far this year, but drifted lower during the early part of Asian trade on the back of these numbers. Low for last year (mid-Dec 0.8821) the initial downside support.

GBP: Cable moving towards the 1.65 level overnight and also retaining its firmer stance vs the euro for most of the year to date. Initial support seen at 1.6381 (early 2013 high).

Further reading: