The European Central Bank convenes in Estonia in one of its more important meetings: a meeting with new forecasts. Given the recent improvement, it may be time for a change in tone, setting the stage for a bigger announcement in September, about the path to stop bond buying, or if you wish, money printing.

Will EUR/USD extend its clear uptrend or is it all priced in? Here is background information, the potential reaction to the baseline scenario, two additional levels and EUR/USD levels to watch.

Europe is looking better

Growth has picked up in the euro-zone. After recovering from the second recession, growth has been lukewarm at best. Yet with a growth rate of 0.5% in Q1 2017, there is room for optimism. This optimism about growth, which stands at 2% annualized, better than the US, comes also from PMIs. The forward-looking indices point to ongoing strong growth in Q2.

The unemployment rate also looks good with a better than expected drop to 9.3%. Even core inflation finally picked up and reached 1.2% in April, the highest since 2013. However, it dropped back in May, to 0.9%.

As the ECB’s only mandate is inflation, is the situation good enough for a change?

Baseline scenario: No more “downside risks”

The answer is yes for a change in the assessment, no for a change in policy. The interest rate is expected to remain unchanged at 0%, the deposit rate at -0.40% and the QE program at 60€ billion per month.

Regarding the general assessment, the baseline expectation is for a move to “balanced” from “downside risks” that have accompanied the ECB’s statements for a very long time.

“Balanced risks” is basically priced in and should keep EUR/USD balanced.

We may even see a temporary “buy the rumor, sell the fact” phenomenon, but for the short run. All in all, an upgrade is an upgrade. And the trend is a trend. Since hitting 1.0340 early in the year, EUR/USD is moving up. This trend will likely continue after the initial wobble.

Any dip could be a buying opportunity

Moving to a neutral view of the risks, the ECB is setting the stage for announcing its exit strategy from the QE program in its next big meeting, in September. They will probably taper down bond buys in early 2018, following the footsteps of the Federal Reserve.

Update: According to reports, the ECB is set to downgrade inflation forecasts. The report sent EUR/USD down to 1.12.

This report lowers expectations for the outcome, providing more room for an upside surprise.

Other scenarios, points to look out for

A downside scenario would be if Draghi will repeat the words “downside risks”. Such a move is not priced in and would be a bitter disappointment for the euro. After we heard reports about this, a no-change in the statement would send the euro down.

On the other side of speculation, we could get an additional comment about tapering. In this case, the ECB would not only move to a balanced assessment, but Draghi would later talk about tapering options. The mere talk about an exit strategy, giving us a sneak preview into September, would send the euro up and up – a steeper uptrend.

Apart from the assessment and the next moves, we will get new forecasts. The ECB’s quarterly forecasts are not expected to change too much. Any significant upgrade or downgrade on either growth or inflation could have an impact. However, it is more likely that we see changes worth 0.1% to 0.2% on forecasts for 2017 and 2018.

Another thing to keep your eyes open for is Draghi’s general tone: upbeat on growth or downbeat on inflation. In the past, he balanced between the two. As a master in communication and with a balance of risks, he could keep things balanced.

EUR/USD levels to watch

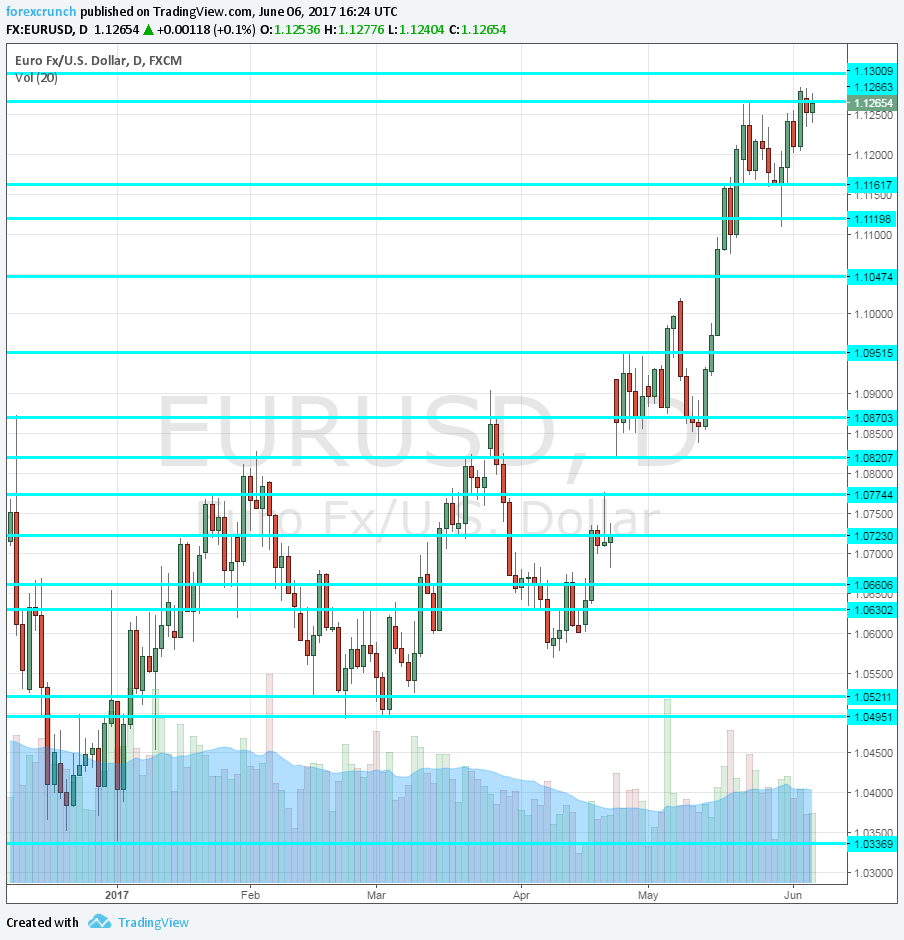

EUR/USD has stalled at 1.1280, ahead of the US elections high of 1.13. Further resistance is at 1.1360, followed by 1.1420. While the pair is quite hesitant and trades in narrow ranges, a breakout could trigger a visit of these levels.

On the downside, we find 1.1160, followed by 1.1120 and 1.1020. Even lower, 1.0950. The last level is the post-French elections low of 1.0820.

More:

- Will The ECB Trigger EUR Strength This Week? – BTMU

- EUR: ECB To Stay On Course For Tapering Despite Drop In Core Inflation – ABN AMRO