EUR/USD continues its recovery after bouncing off low support. If the previous moves were more related to cherry-picking good data and ignoring the weaker figures, now the pair has more substantial reasons to rise.

According to a report, the European Central Bank is set to remove its easing bias in the June meeting. The Frankfurt-based Institute will probably upgrade its economic risk assessment. Removing the easing bias is the first step to announcing the end of the QE program. Such a move means that Draghi is dragged into tightening instead of dragging the euro down.

The second driver comes from the US data. The Core PCE Price Index slipped once again, this time from 1.6% to 1.5%. While the numbers matched expectations (especially after the weak Core CPI(, it still means that inflation is falling. In turn, the data lowers the chance for a rate hike in June.

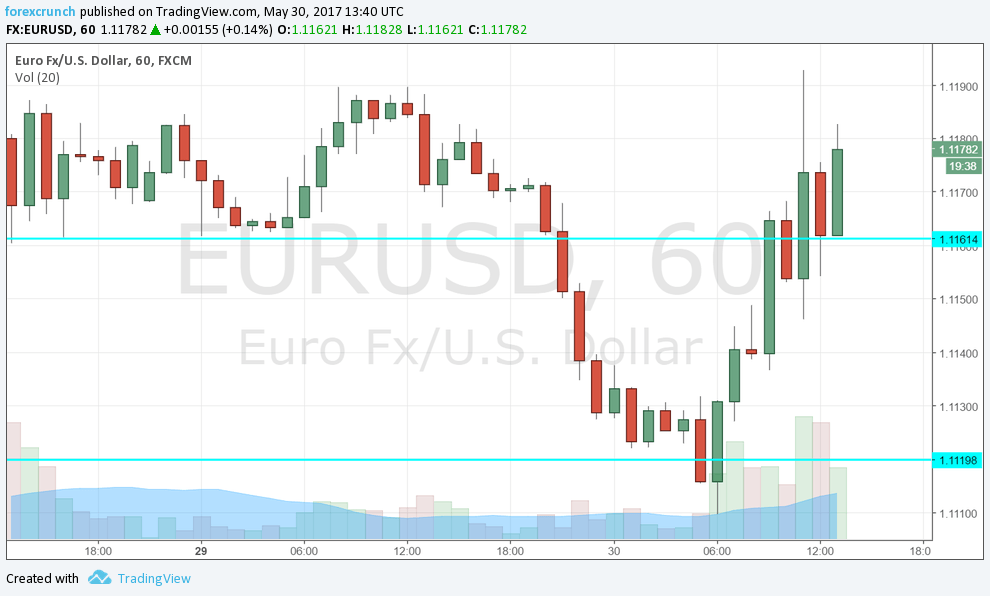

EUR/USD reached 1.1193 and broke back above resistance at 1.1160. The next level to watch is 1.1266.