The upcoming ECB rate decision became a very important one. The main reason is the big fall in inflation in the euro-zone. At an annual rate of 0.7%, the ECB is far from its inflation target of 2%. The euro already took a nose dive on heightened expectations for ECB action (as well as other reasons). Will the ECB provide the fuel for further declines or will it allow for a correction?

Here are 6 potential scenarios for the big day for the single currency, with the level of probability and the potential reactions in EUR/USD:

Some background

Inflation is the “single needle in the compass” for the ECB, as the previous president Jean-Claude Trichet often said. The words were in reference to the above 2% inflation levels seen at times. In 2011, the ECB raised the interest rates twice, in decisions that proved to be toxic for the euro-zone, mired in a debt crisis.

Yet also deflation is a danger: falling prices may be good for consumers at first, but they can trigger a vicious cycle. When prices fall, consumers are reluctant to buy, and this causes prices to fall even further as well as job losses. Fear of deflation was the main reason for QE2 in the US. The Bank of Japan is now fighting deflation, after two lost decades. Despite the strong German push against inflation, the ECB doesn’t want the zone to fall into a deflation trap.

Falling prices are partially caused by the high exchange rate of the euro, as Draghi said. They also hurt European exports. Any loose monetary policy is likely to weaken the euro. While the ECB isn’t likely to actively pursue a lower-euro policy, such an outcome will be quietly blessed.

On the other hand, the ECB usually hints about potential moves, and doesn’t want to be seen as reacting hastily to one disappointing set of figures. And as aforementioned, the German influence over the ECB is very strong. For Germany, deflation isn’t a big monster as it is to the US and Japan.

6 Scenarios

What can the ECB do?

- No action, but big hints: Given the need to maintain the credibility, the ECB might refrain from action now, but make it clear that it will present new measures very soon – in December. Measures could vary, and Draghi could refrain from providing details at this point, while making it clear that the ECB is about to act, and needs a bit more data and more time to think. Probability: high. While the initial reaction to the initial “no change” decision might be a stronger euro, these gains would be erased in case the message is strong, and EUR/USD might end the session lower.

- Cut the main interest rate: Draghi already cut the main lending rate to a historic low rate of 0.50% 6 months ago. A cut of 0.25% is forecast by some analysts. As the interest rate is already low, such a move would have little real impact. The bigger impact would come if the exchange of the euro falls as a result of this move. Probability: medium-high. Potential reaction: a significant slide in EUR/USD.

- A new LTRO: The ECB made two huge lending operations, worth a total of around 1 trillion euros in late 2011 and early 2012. By providing cheap loans, the ECB provided liquidity to banks. In addition, the banks used this money and bought government bonds (carrying a higher yield), thus defusing the debt crisis worries. While yields are now relatively low (thanks to the “we’ll do whatever it takes” speech and the following OMT backstop), lending more money to banks could certainly help battle the tighter credit conditions that weigh on the euro zone. Probability: medium. Potential reaction: a small slide in EUR/USD.

- Set a negative deposit rate: This is the “nuclear option” that the ECB toyed within the past. Penalizing banks for depositing money with the ECB is supposed to make them lend money to the real economy and improve it. However, this is a very strong move that could cause serious outflows out of the euro-zone. The ECB has repeatedly stated it is technically ready to enter this adventure, but seems to keep it for the most rainy day. Has the day arrived? It’s uncertain. Probability: low. Potential reaction: EUR/USD crashes.

- Enhanced forward guidance: The ECB already introduced forward guidance in July by stating it will keep rates low or lower for an extended period of time. Draghi could now walk another step in Bernanke’s shoes and tie the low rates to qualitative targets such as an inflation and/or unemployment rate. This would extend the “downward bias”. Probability: low. Potential reaction: A significant slide in EUR/USD, depending on the conditions.

- No action, weak promises: In this unlikely scenario, the ECB will not only leave policy unchanged, but will shrug off worries and only say it is prepared to act, without any specific time frame nor any sense of urgency. Probability: low. Potential reaction: EUR/USD surges.

What do you think? What will the ECB do? What message will Mario Draghi convey?

The rate decision is released on Thursday, November 7th, at 12:45 GMT. Draghi’s press conference begins at 13:30.

Further reading:

- 4 reasons why EUR/USD is free-falling

- ECB and BoE to shun policy action in November, focus turns to communications – FXstreet experts

- Draghi could change expectations on rates and LTRO – by Simon Smith

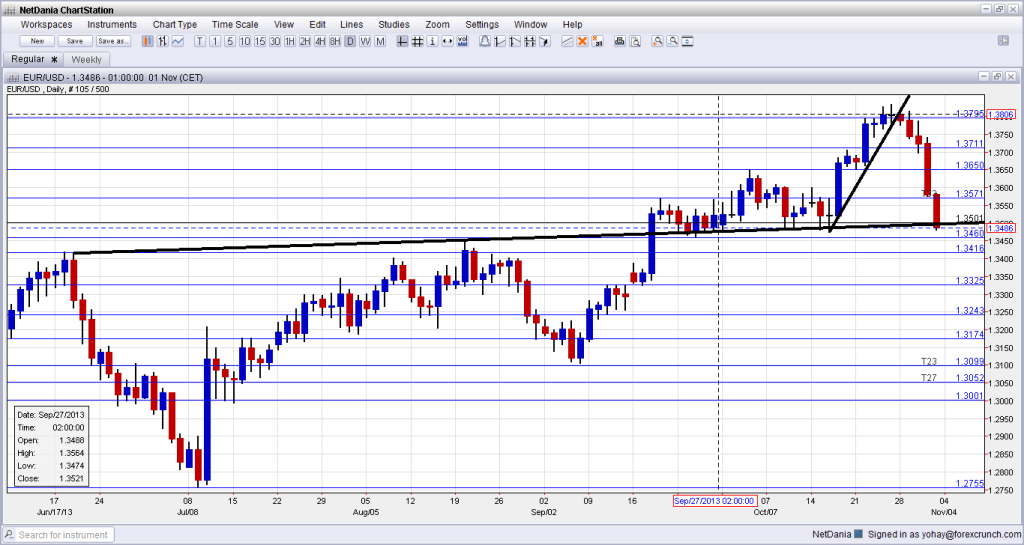

Quick technical look: EUR/USD starts this important week below long term uptrend support: