AUDUSD

AUDUSD has turned down this week through the support line from 0.7107 which is an important indication for a bearish turn. As such, we assume that the top can already be in place of wave 5) of C-circled, so we need to be aware of more weakness ahead, but we still want that push beneath 0.7481 of a red wave 4) to make sure that we are on the right side. Also, notice that RSI has turned down from that divergence line which is a nice indication for a bearish price action ahead. That said, the broken trend-line can now turn into a resistance near 0.7660.

AUDUSD, 4H

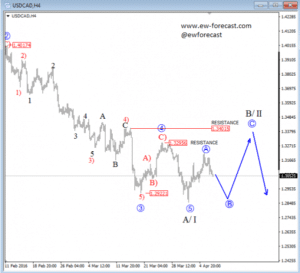

USDCAD

USDCAD fell to a new low last week after wave four circled has accomplished a corrective pullback at 1.3299. From there, we have seen a nice impulsive decline which looks like a wave 5-circled, final leg of a big bearish five wave fall so traders have to be aware of a bottom formation. That said, a new three wave contra-trend move can now be unfolding in wave B/II, possibly even back to 1.3300-1.3400 area.

USDCAD, 4H