We see the markets very calm but with a sideways movement on the higher time frames, but some short-term structure on several pairs suggests that we may see USD strength.

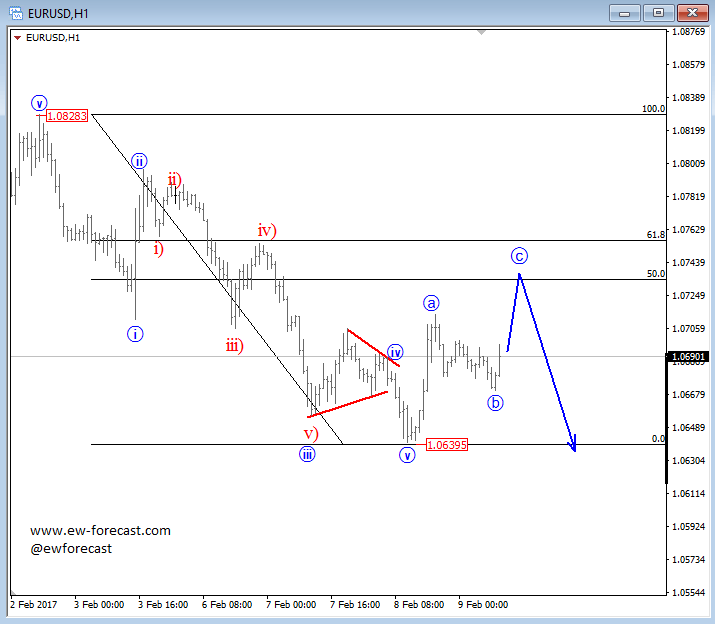

On EURUSD we see a five wave decline from 1.0828 to 1.0639 which indicates an important trend is in change, so the current bounce is likely temporary. We are tracking a simple a-b-c bounce that can reach Fib. area at 50-61.8% from where we believe the market could turn down in the next 24 hours.

EURUSD, 1H

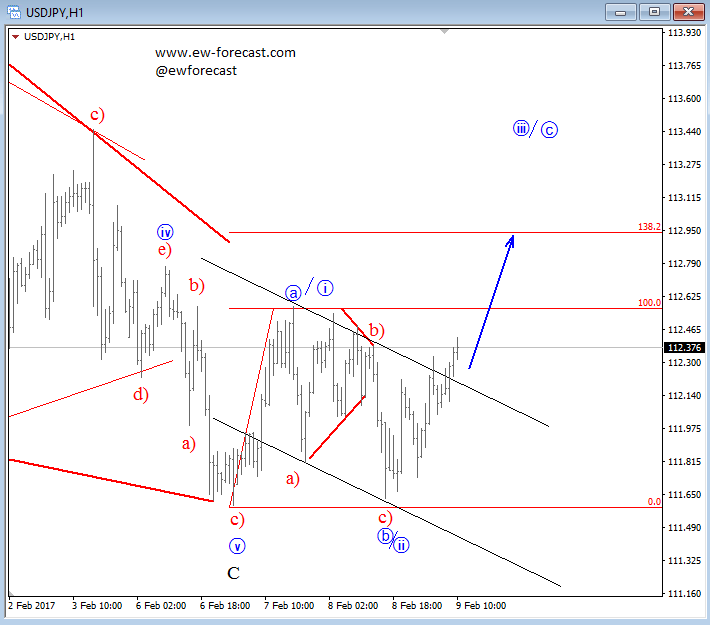

USDJPY is also turning up now after a deep pullback to 111.67; it was a corrective decline that should be finished because of a recent rise above the channel line which means that the third leg up is unfolding. It can either be wave three or c but in both cases, there is room for 112.95 minimum.

USDJPY, 1H