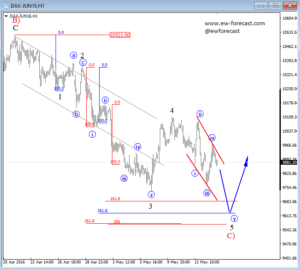

German DAX

On Dax we are looking down, currently into a fifth wave that is a final leg of a bearish impulse from 10521 high, so actually the bearish move can be coming to an end, but there is still room for another 200 or 300 point drop before bottom is reached; ideally at 9500-9600 zone.

German DAX, 1H

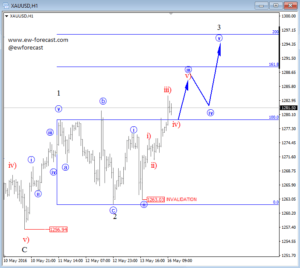

GOLD

It’s very interesting to see metals higher while the dollar is also up, but we think it has more to do with weakness on the stock market. Well, we see a room for even lower prices on E-mini S&P and DAX, so gold can stay up in such case.

On precious metal we see the price in the third wave up, likely an impulse that is headed to 1290 in the short-term, and then even 1300 if 1263 will stay in place.

GOLD, 1H