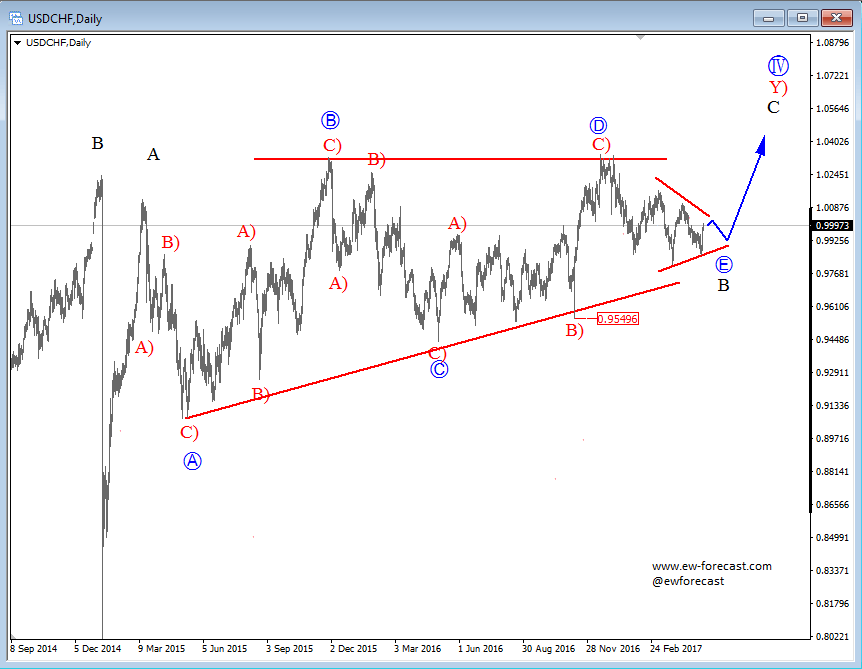

On the daily chart of USDCHF we see the price trading at the end of a higher degree wave B triangle, specifically in sub-wave E. We know that the triangle corrections are continuation patterns, which means that after they complete themselves they usually make a new run towards the direction of the trend. In our case this is to the upside within wave C. That said, we can see that sub-wave E is also overlapping, meaning it can also unfold as a triangle correction. After sub-wave E unfolds, we can expect a new five wave development to take place within the final wave C of Y).

USDCHF, Daily

A Triangle is a common 5-wave pattern labeled A-B-C-D-E that moves counter-trend and is corrective in nature. Triangles move within two channel lines drawn from waves A to C, and from waves B to D. A Triangle is either contracting or expanding depending on whether the channel lines are converging or expanding. Triangles are overlapping five wave affairs that subdivide 3-3-3-3-3. Triangles can occur in wave 4, wave B, wave X position or in some very rare cases also in wave Y of a combination

Triangle Pattern: