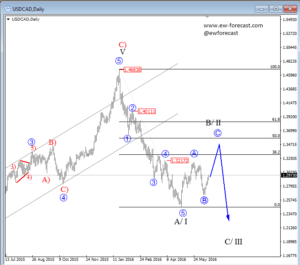

USDCAD has been trading aggressively lower earlier after a decisive break out of an upward channel connected from May of 2015 lows, which was an important evidence for a change in trend. That said, the price of USDCAD is likely going even lower as the decline from 1.4680 has unfolded in five waves, labeled as wave A/I; first wave of a minimum big three waves of a decline. However, nothing moves in straight lines so we need to be aware of a corrective bounce up in wave B/II, which is now already underway with still some room left towards 1.3600 area, since we expect bigger corrective three wave recovery.

USDCAD, Daily

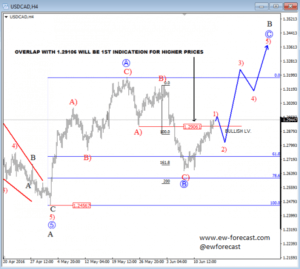

On the lower time frame, USDCAD has been trading south at the start of the month, but this is now changing after three waves of a decline that found a support a week back near 1.2650. We labeled this as the end of wave B-circled, that is part of a bigger recovery. So far, we have seen a very nice rise back above 1.2906, where overlap suggests that blue wave C-circled is underway to above 1.3200 and possible even to 1.3350.

USDCAD, 4H