USDCHF

USDCHF is turning sharply higher, clearly with an impulsive price action away from 100% Fibonacci level of wave A) compared to wave C). We have seen a very strong turn back above black wave 4 swing that puts the low in place so we need to be aware of further upside in the days ahead, back to 0.9790 with minimum three waves.

USDCHF, 4H

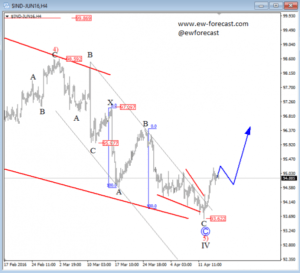

USD Index

USD index has been moving lower, but overlapping and slow price action from a few days back suggests that the bears are coming to an end. In fact, we recognized a very powerful ending diagonal in wave C that caused a strong bounce in the last 24 hours. We see a leg from 93.62 as an impulse that should take the price to higher levels, as recovery has to unfold with minimum three waves. That said, the price can go even back to 96.50 by the end of the month.

USD Index, 4H