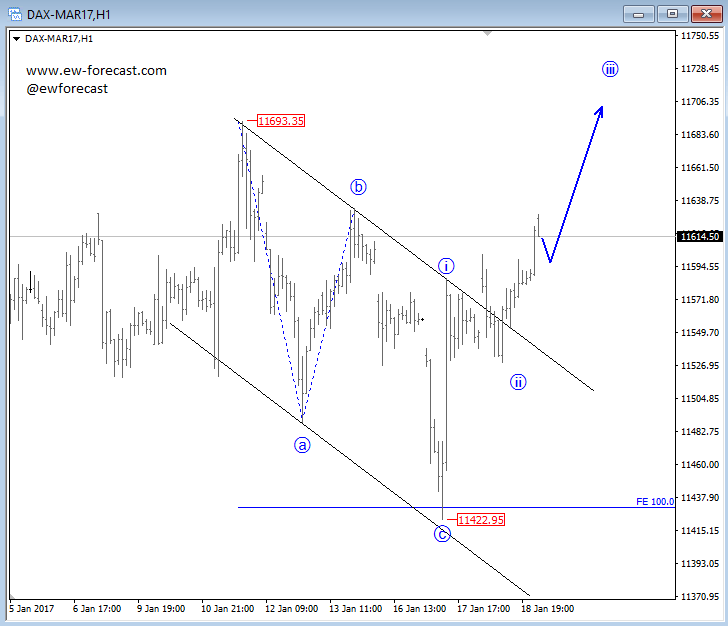

German DAX is showing bullish intraday trend this week after the a-b-c decline to 11422, followed by a nice bounce now out of a corrective channel, which suggests that eventually the index will revisit 11693 high. So, we stay bullish while market is above 11422.

German Dax, 1H

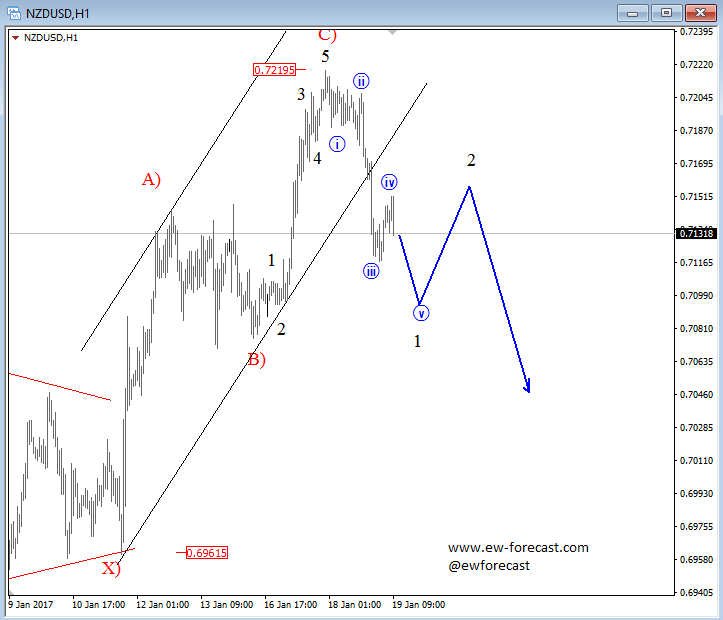

NZDUSD is turning lower, now falling beneath the trendline support which suggests that the pair accomplished a three-wave recovery from 0.6961. As such, we are looking down on NZDUSD, but it would be nice to see a five wave decline in wave 1 in the near-term, to make sure that the highs are in. In such case, wave 2 bounce can be interesting for shorts while market is below 0.7220.

NZDUSD, 1H