Ethereum is often seen as the “second cryptocurrency”, offering a significant alternative to bitcoin due to its more sophisticated nature. ETH/USD hasn’t always followed its bigger brother, but when all cryptocurrencies crash, Ethereum is no exception. Why are digital coins down? Here are 5 reasons for the crypto-crash.

Yet ETH/USD seems to have a better technical behavior, bouncing exactly at the same place it bounced at last week, thus creating a double-bottom.

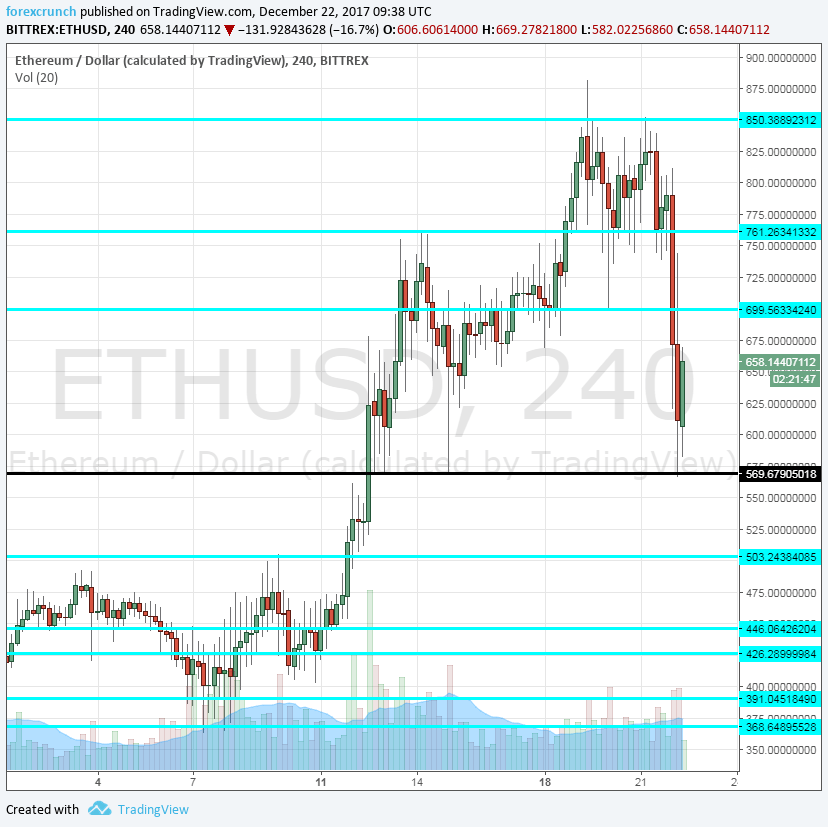

That line is $569 and Ethereum/USD is already $100 above that level. Here is the chart, followed by descriptions of the technical levels to watch.

ETH/USD support levels

The first level has already been mentioned: $569. Below this double-bottom, we find $523, a level that capped the digital coin’s advance in early December.

$446 was once a record high, before the rallies of recent months and remains of importance. It also served as a stepping stone on the way up. $426 is very close by after halting a fall in early December, ut is now weak support.

$390 also used to be a record high and is also a weak level of support. We find much stronger support at $367, a level that prevented ETH/USD from crashing during long days earlier this month.

ETH/USD resistance lines

At current levels, we are not that far from $689, which was a swing low earlier this week. A move above this level could mark a comeback.

Further above, $761 capped the pair in mid-December and caused a consolidation before the surge higher.

The last level worth noting before the all-time high is $852, as it held Ethereum down just before the plunge. The record high of $881 is the last line, but $1000 is always looming.

More: Different Shades of Ether