Crypto-currencies are not enjoying any kind of Santa rally. Bitcoin, Ethereum, and Bitcoin cash are all crashing quite significantly. This is not a small drop and is not limited to a specific coin, but seems like a wider sell-off.

Here are updates on 5 cryptocurrencies, followed by 5 reasons:

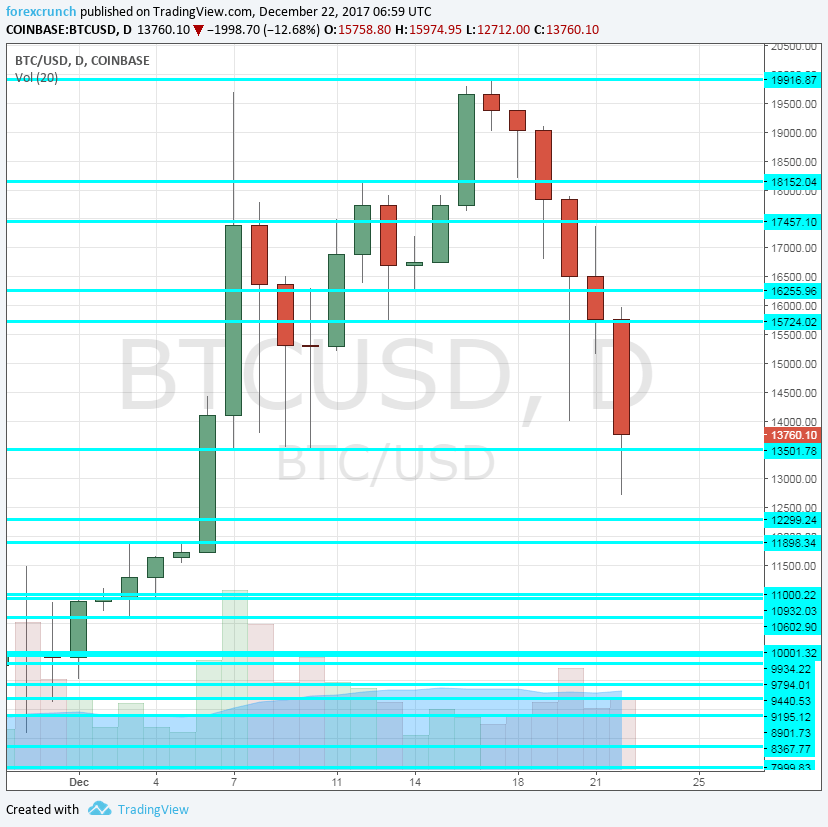

- BTC/USD is down by over 10% to $14,088, already around 30% below the magic number of $20,000. More: BTC/USD: Technical levels to watch after the big crash

- ETH/USD, which was well above $800, is currently trading around $778, down some 15% on the day. Ethereum has more to offer in comparison to bitcoin but offers also bigger losses today. More: ETH/USD erosion: creates double bottom – technical levels to watch

- BCH/USD, or bitcoin cash, is down a whopping 21% to $2,435. The coin, which exists only since August, enjoyed a big leap earlier in the week as it received inclusion in a key exchange. More: Bitcoin cash crash: technical levels to watch on BCH/USD

- XRP/USD: Ripple initially held its ground but then fell quite sharply as well, some 18% to $0.93. Here are levels to watch on XRP/USD.

- LTC/USD: Litecoin is down some 23% and trades at $234. The peak so far was $370 that was seen a few days ago. More: Litecoin, heavy crash: technical levels to watch on LTC/USD

5 reasons for the crypto carnage

Why are crypto-currencies crashing?

- Coinbase was down: During the Asian session, a key exchange, Coinbase, suspended buying and selling of bitcoin and other cryptocurrencies. This is not the first time they experience an outage. While the issue has since been resolved, it shows that trading is vulnerable, and this, in turn, affects the price.

- Chinese crackdown: A new report in the media in Hong Kong discusses the Chinese clampdown and how it raises demand for over-the-counter trading. Yet this may not last for too long.

- Ability to go short: The introduction of futures on bitcoin by the CME group on Monday. While going short on bitcoin via options could work as a good hedge and allow further buying of the digital currencies, it also works as a short on its own, putting pressure on the price.

- Founders are selling: Emil Oldenburg sold all his bitcoins and switched to bitcoin cash. Litecoin founder Charlie Lee sold all his LTC assets and donated the money.

- Goldman Sachs is jumping in: The “vampire squid” took a decision to build cryptocurrency trading desk. It could be up and running in June. There are a lot of open questions about to manage it. In theory, this should add another notion of normalization. However, once again, making it mainstream also allows going short.

Crypto-correction or a big bust?

What’s next? We have seen quite a few crashes in crypto-currencies that were followed by rallies. Is this another case?

The advantage with digital coins is that they also trade during the weekend and also during Christmas. Will Santa eventually bless bitcoin? Or maybe bitcoin cash?

After a bubbly assent, a big correction is certainly necessary. A mature market for trading cryptocurrencies in both directions needs to fall from time to time. Also for those going long, these falls serve as opportunities. Yet when all 5 top coins are crashing, it is hard to see the bottom.

More: On the Bitcoin Block: 7 Myths about trading cryptocurrencies