EUR/USD enjoyed 3 straight days of gains, riding on the dollar’s weakness as well as some positive figures from Germany, namely GDP.

Nevertheless, the team at Morgan Stanley opts for the “sell the rallies” strategy and explains:

Here is their view, courtesy of eFXnews:

Morgan Stanley’s call for the USD correction into the end of last week may have come slightly too early, as a strong US payrolls print combined with heightened political uncertainty offered support to the currency over the past week.

However, as the USD corrects, MS still thinks that risks are once again skewed towards a weaker EUR, as the EUR bear market is currently in the waiting.

Greece Risks:

“Uncertainty remains in Greece, where though there have been some signs towards de-escalation, no official agreement has yet been reached. Concerns about Greek banks’ ability to fund remain as well, which should keep a risk premia priced into EUR,” MS argues.

Divergence In Bank Returns:

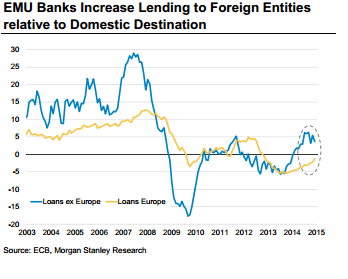

“Exhibit 5 shows the divergence of bank asset returns using the IMF data base. EMU bank asset returns are low in historical and in international comparisons. Banks and other financial intermediaries will seek higher returns on assets and due to high EMU credit risks and the fragility of the anticipated economic rebound, these higher returns are found outside and not inside EMU. Accordingly, financial institutions will have a high incentive to increase their foreign currency denominated asset holdings. Consequently, the EUR will fall,” MS adds.

Cross Border Flows:

“Cross border financial flows within the Eurozone are likely to suffer. Fragmentation is a reality, which could make it difficult for peripheral banks to access funding from other Euro Area countries. Instead, banks are likely to focus on opportunities, keeping the EUR under constant selling pressure,” MS argues.

Only A Matter Of Time:

“With respect to EURUSD, markets seem to be in the middle of a ‘rolling correction‘. While leveraged accounts seem to be taking off some EUR short positions, EMU financial intermediaries and real money accounts continue to buy FX denominated assets.Against this background, it seems only a question of time before the EUR breaks lower once again,” MS projects.

Sell Rallies:

“Economic data have been somewhat more robust, but we would use any rallies in EUR on strong data as a selling opportunity,” MS advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.