EUR/USD remains on low ground but seems shy against the double bottom of 1.0520. The team at Bank of America Merrill Lynch looks into 2017:

Here is their view, courtesy of eFXnews:

Themes: The rates sell-off. Market expectations of a large fiscal stimulus in the US following Trump’s victory have triggered a re-pricing of the Fed, with the market now expecting a Dec hike with a 96 percent probability. The sell-off in rates is helping Draghi, making QE extension””by another six months in our view””much easier, as more bonds move above the depo rate and become eligible. We have been arguing that the ECB challenges will come when QE extension requires relaxing the capital key, which could be the case in the second half of 2017.

Markets are also getting concerned about political risks in Europe, having learned a painful lesson from the Brexit referendum and the surprising result in the US elections. Renzi is likely to lose the referendum on constitutional reform according to the polls and even if Italy avoids a snap election, we believe his political capital will weaken and the anti-Euro Five Star party could be a strong contender in the 2018 election. The probability of Le Pen wining the 2nd round in France may be small according to the latest polls, but markets cannot ignore such a high impact risk anymore.

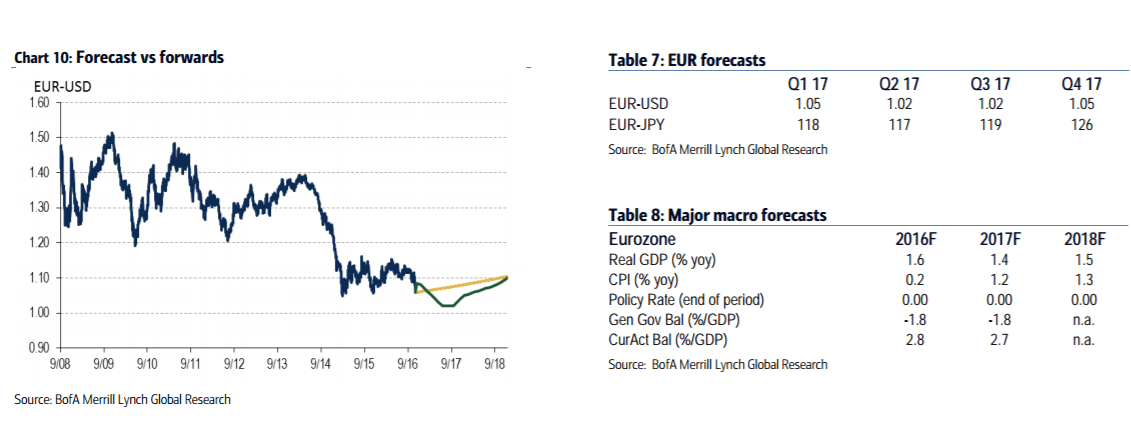

Forecasts: more (selective) EUR downside We have been bearish EUR and EUR/USD is now below our end-year projection. We recently dropped our EUR/USD forecast to 1.02 by mid-2017.

We expect ECB QE tapering to support the Euro eventually and we see EUR/USD back at 1.10 in 2018.

Political risks in the Eurozone could weaken EUR/GBP in h1 2017. However, QE tapering next year could support EUR/JPY.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Risks: Trumpenomics, US Q1 data, EZ politics. Positive EUR risks include failure to deliver a sizable fiscal stimulus in the US and another weak Q1 for US data””as it has been the case in recent years. Negative risks include a snap election in Italy and Le Pen winning in France.