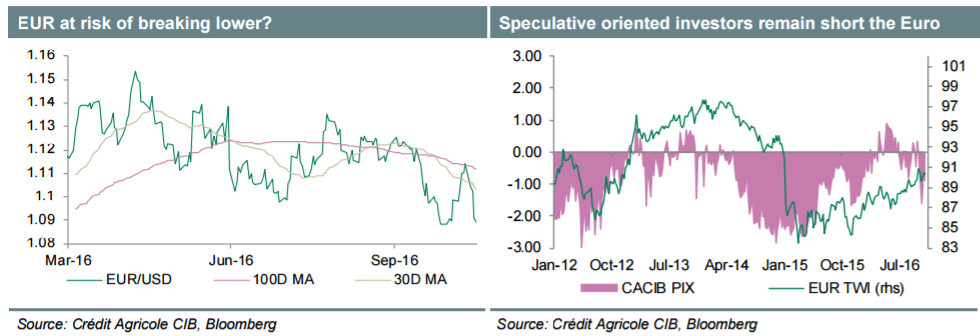

EUR/USD is suffering, falling to low support. The team at Credit Agricole see lower lows:

Here is their view, courtesy of eFXnews:

The EUR has been under pressure of late, mainly on the back of both better global risk sentiment and concerns over global protectionism to dampen the trade related capital flow situation.

While such concerns are unlikely to rise further in the short-term, more currency downside cannot be excluded, for instance against the USD. This is mainly due to policy differentials remaining out of favour for the pair and as there is further room of improving sentiment. We are of the view that the Fed will tighten monetary policy in December still and such prospects are unlikely to dampen risk sentiment. More favourable US growth prospects should compensate for tighter conditions’ dampening the impact on risk.

Nevertheless, it is worth noting that speculative EUR positioning remains short and such conditions may limit Euro downside risks from here.

In terms of data, next week’s focus will be on final October CPI, preliminary Q3 GDP and the German ZEW economic sentiment survey for the month of November. Unless data surprises considerably, we anticipate a limited impact on monetary policy expectations and the EUR.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.