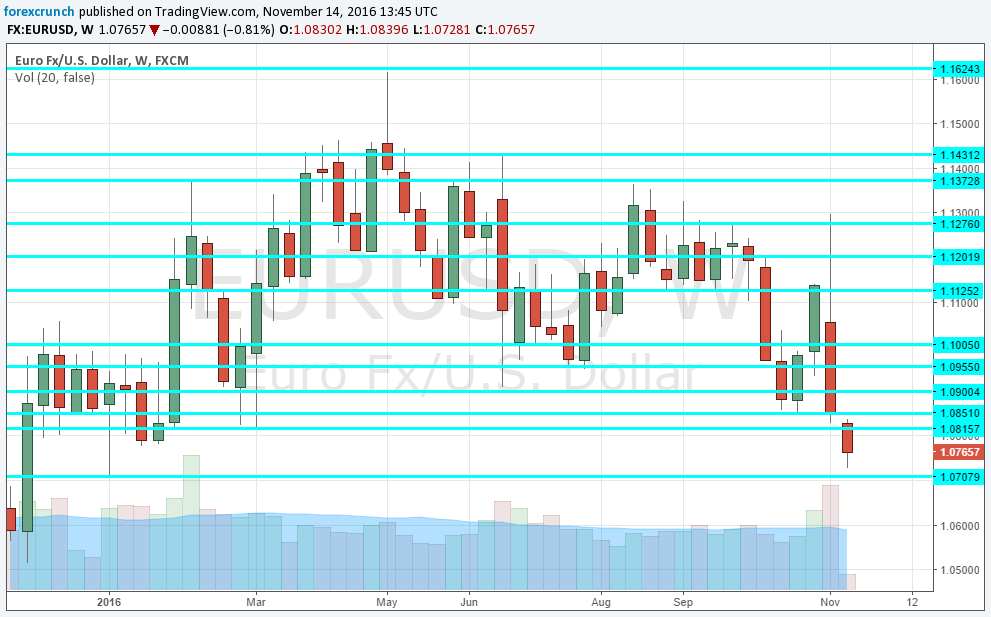

The US dollar continues storming forward, and EUR/USD sees no mercy. The world’s No. 1 currency pair is trading at the lowest levels since early 2016. So far, it has reached 1.0728, above support at 1.0710. The pair did break below the low of 1.0825 seen in March. At that time, the ECB presented a lot of new measures but also said they were done for the time.

If 1.0710 breaks, we will be in areas where the pair spent little time. 1.0630 is a stepping stone on the way down. Stronger support awaits at 1.0520, the level the pair visited on another ECB rate event: the December 2015 meeting. And the last line in the sand belongs to 1.0460, last seen in March 2015, and the lowest level in well over a decade. Some even see an open door to parity Resistance awaits at 1.0820, 1.0960 and 1.10.

EUR/USD out of balance

The euro is not the strongest currency out there: the ECB could still add monetary stimulus in December, inflation is not rising, and the continent remains divided after Brexit. It does not have the stamina of the British pound: Sterling enjoyed a “Super Thursday,” with the BOE removing its easing bias.

The explanation for the dollar’s rise is as follows: President-elect Donald Trump intends to cut taxes and spend money. This, in turn, will result in more borrowing and higher inflation. Both things cause bond values to fall, therefore bond yields to rise, making the dollar more attractive. Also, higher inflation will cause higher interest rates, again, making the greenback more palatable to investors.

Not a straight line

This assessment relies on both Trump delivering on his promises and also on the fact that with full Republican control, he can pass anything. However, erratic Donald can change his mind quickly. He already began praising parts of Obamacare and softened his stance on deporting millions (at least the numbers have fallen). Also, Republicans have, at least in theory, are totally opposed view on the debt: they want to squeeze it.

So, it will take time to see what happens, but in the meantime, markets are moving. We will later hear from Mario Draghi and tomorrow we have a more interesting event.

See how to trade the German GDP with EUR/USD