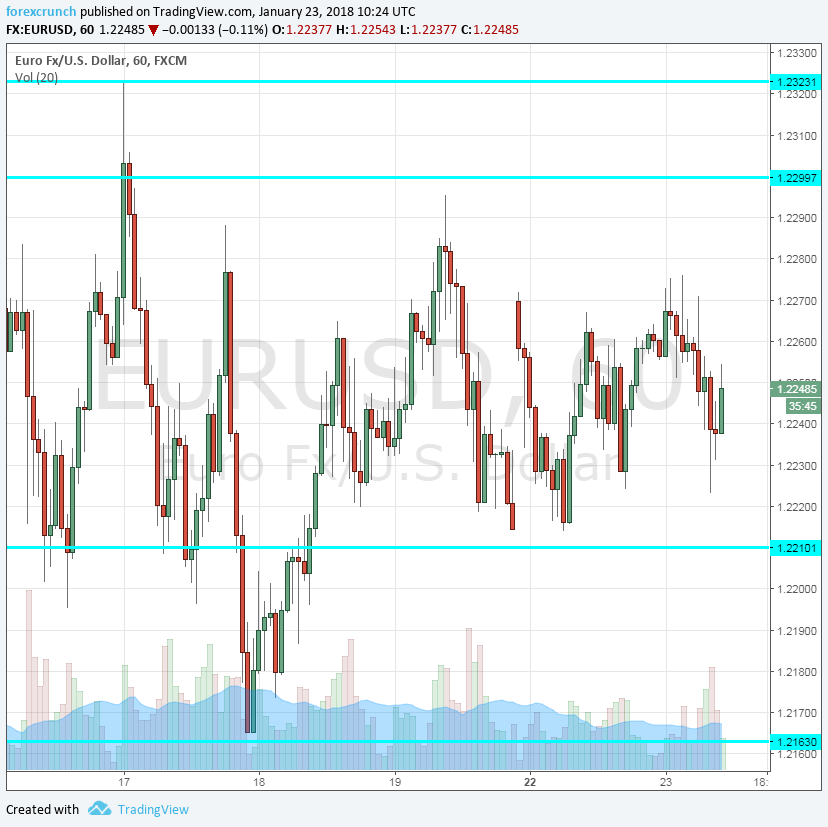

EUR/USD seems to be in a wait-and-see mode ahead of the ECB meeting on Thursday. It trades between the 1.2215 and 1.23 technical levels and practically in a narrower range.

The ECB is not expected to leave its policy unchanged but any hint about the future of the QE program is awaited. Here is our preview: ECB Preview: A buy opportunity on Draghi trying to down the euro?

And as we wait for Draghi, the euro is accumulating good reasons to rise.

The German ZEW institute published its fresh survey numbers for the leading economy in the euro-zone and the whole area and things are looking good. The Economic Sentiment measure surprised with 20.4 against 17.8 expected. The Current Situation component came out at 95.2 against 89.6 points expected. And for the whole euro-zone, the number reached 31.8 instead of 29.7 expected.

The European Central Bank, which convenes on Thursday released its survey which showed rising for loans, mortgages and consumer credit. This is a survey for January 2018, also a fresh figure.

So, once the ECB behind us, will EUR/USD jump to higher ground?

More: EUR/USD: Reading Draghi’s Dovish Bluff; Buy Any EUR/USD Dips Post-ECB