EUR/USD made a move to the upside but quickly returned to the known range. Will it pick a new direction now? Inflation figures and PMI data stand out as a new quarter begins. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Germany’s inflation advanced in March but fell short of expectations. Import prices followed the same path and Spain’s CPI also disappointed. In the US, GDP was upgraded to 2.9% in Q4 2017 while other data did not surprise. Trade tensions eased with some positive noises from China and the US while stocks remained jittery. The turbulence eventually slowed down as markets set into the long weekend.

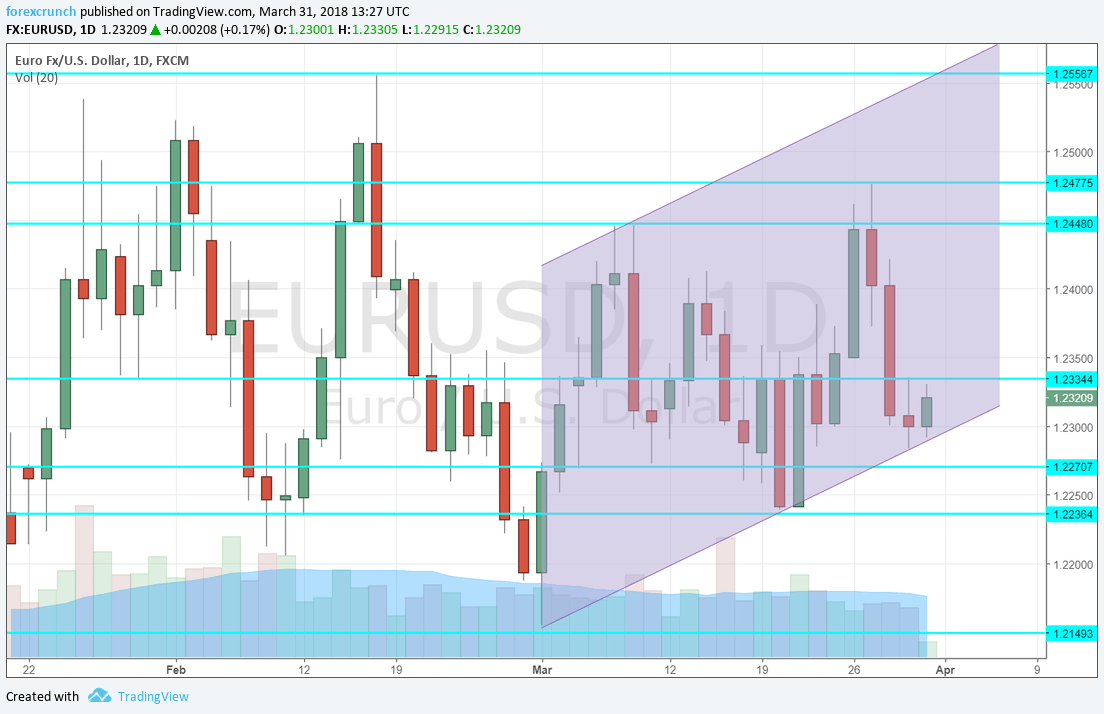

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Retail Sales: Tuesday, 6:00. German consumers squeezed their shopping for the second month in a row: sales dropped by 0.7% in January. A bounce of 0.7% is on the cards for February.

- Spanish Unemployment Change: Tuesday, 7:00. Spain, the fourth-largest economy in the euro-zone, suffers from a high unemployment rate. Its early measure of changes in the numbers of the jobless is an important indicator. After a drop of 6,300 in February, March is expected to see a slide of 47,500.

- Manufacturing PMIs: Tuesday: 7:15 for Spain, 7:45 for Italy, the final French number at 7:50, final German figure at 7:55 and the final euro-zone number for March at 8:00. Back in February, Markit’s forward-looking indicator for the manufacturing sector stood at 56 points, reflecting solid growth. A drop to 54.7 is on the cards now. Italy, the third-largest economy, had a score of 56.8 and 55.6 is projected now. The initial figure for France for March stood at 53.6, for Germany at 58.4 and for the euro-zone at 56.6. A confirmation of these initial reads is likely now.

- Flash inflation: Wednesday, 9:00. The initial read for inflation in March is expected to show an increase in CPI from 1.1% to 1.4% y/y and core CPI from 1% to 1.1%. However, expectations may have dampened after Germany’s figures came out below expectations. The ECB is likely to taper down its bond buys in September and end it completely at the end of the year. However, there is a fierce internal debate within the Governing Council between the doves such as President Draghi and the hawks, led by the leading candidate to replace him, Jens Weidmann. Inflation is the single needle in the ECB’s compass and any rise or fall matters.

- Unemployment Rate: Wednesday, 9:00. The jobless rate in the euro-zone has been falling gradually. It reached 8.6% in January and yet another drop to 8.5% is expected now. The unemployment rate was above 12% in 2013.

- German Factory Orders: Thursday, 6:00. The volume of orders dropped by a whopping 3.9% in January, but it is important to remember that the indicator is quite volatile. An increase of 1.6% is projected for February.

- Services PMI data: Thursday, 7:15 for Spain, 7:45 for Italy, the final French number at 7:50, final German figure at 7:55 and the final euro-zone number for March at 8:00. Spain’s services PMI was 57.3 in February, and a drop to 56.2 is projected for March. Italy had a level of 55 points and a significant drop to 53.9 is on the cards now. The initial French figure for March stood at 56.8, the German one at 54.2, and the whole euro-zone had 55. The final print is expected to confirm the initial estimates.

- PPI: Thursday, 9:00. Changes in producer prices feed into consumer prices. Back in February, the PPI rose by 0.4%. A flat read is expected for March. Note that German import prices dropped, indicating a potential downturn here as well.

- Retail Sales: Thursday, 9:00. The volume of retail sales slipped by 0.1% in January and February is expected to show a bounce back of 0.6%. Germany’s numbers published earlier in the week may impact the expectations for the figure for the whole of the euro-zone.

- German Industrial Production: Friday, 6:00. Similar to the factory orders measure, also industrial output slipped, but only by 0.1% in January. A rise of 0.2% is expected now.

- French Trade Balance: Friday, 6:45. The second-largest economy had a wide trade deficit of 5.6 billion euros, contrary to Germany’s chronic surpluses. A slightly narrower deficit is on the cards now: €5.3 billion.

- Retail PMI: Friday, 9:10. Markit’s last word for the week comes via the gauge for the retail sales. In February, the figure stood at 52.3 points, just a bit above the 50 point mark that separates expansion and contraction. A similar figure is likely now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar kicked off the week by moving higher, eventually rising above 1.2450 mentioned last week. The pair then turned south, ending the week close to where it started it.

Technical lines from top to bottom:

1.2555 is the three-year high the pair reached in mid-February. 1.2477 was the high point in March but did not hold up for long.

1.2445 capped the pair in early March and remains important. The next important level is only 1.2335 which supported EURUSD in mid-February and is a pivotal line.

Further below, 1.2270 was a swing low in mid-February and mid-March. It is followed by 1.2240 that supported the pair during two consecutive days in mid-March.

1.2155 was a low point in early March and the last line before 1.2090, the 2017 high.

I am bearish on EUR/USD

In this ugly contest, the euro is now the uglier currency, with slowing inflation and weakening growth. Economic signs from the US economy have been improving. This bias may change quickly though.

Our latest podcast is titled The Powell Power Play.

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!