EUR/USD traded in a narrow range and suffered further losses. Will it continue falling or just move back up in the same known range? The week features a speech by Draghi, the ECB meeting minutes and more Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

There is further evidence that growth in the euro-zone has peaked. German retail sales, factory orders, and industrial output all fell short of expectations. Euro-zone inflation is not going fast either, with core inflation sticking to 1%. In the US, job growth disappointed with only 103K in March, but wages accelerated to 2.7% y/y and other indicators still point to robust growth. Worries about trade have had a minor effect on the pair.

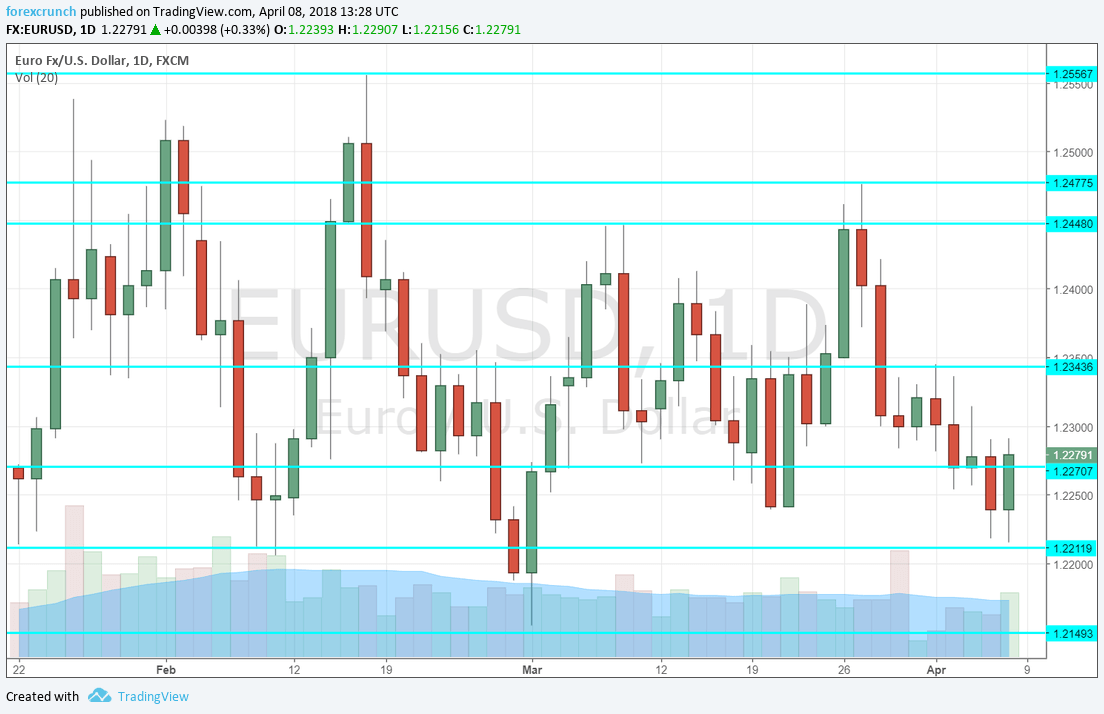

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Trade Balance: Monday, 6:00. Germany’s export machine supports a wide trade surplus for the country and for the whole euro-zone. After recording 21.3 billion in January, a wider surplus of 23.1 is projected for February.

- Sentix Investor Confidence: Monday, 8:30. The expansive survey of around 2800 investors fell sharply from a few months above 30 points to 24 in March. Another drop to 21.2 points is on the cards.

- French Industrial Production: Tuesday, 6:45. The second-largest economy in the euro-zone saw a big drop of 2% in its industrial output back in January. A bounce of 1.5% is on the cards for the February report.

- Mario Draghi talks Wednesday, 11:00. The President of the European Central Bank will appear in front of a student conference in Frankfurt and will also take questions from the crowd. He will have an opportunity to respond to the growing signs of a slowdown in the euro-zone economies, or at least the peak of the cycle, around December. Any comments about inflation will be interesting to watch.

- French Final CPI: Thursday, 6:45. The initial figure for March showed a monthly rise of 1% in prices. The final read is expected to confirm it.

- Industrial Production: Thursday, 9:00. While the figure is released after major countries will have already published their own data, surprises are quite common. After a dip of 1% in January, a minor increase of 0.1% is projected.

- ECB Meeting Minutes: Thursday, 11:30. These are minutes from the ECB’s meeting in March, where forecasts were hardly changed and Draghi made an effort to downplay the slightly more hawkish stance in the statement. The publication is over a month after the event, making it somewhat stale as we have received quite a few data points since then. However, the ongoing battle between the hawks and the doves about ending QE and a potential rate hike somewhere in 2019 rages on.

- Jens Weidmann talks Thursday, 16:00. The President of the German Bundesbank and the leading candidate to replace Draghi at the helm of the ECB will speak in Berlin. His speech is titled “A spirit of optimism in Europe – guidelines for a crisis-proof monetary union” and may have an opportunity to respond to the recent data, which was somewhat weak. Weidmann is a hawk that supports raising rates in about a year.

- German Final CPI: Friday, 6:00. The flash estimate of Germany’s GDP came out slightly below expectations at 0.4% m/m. The final read is expected to confirm this figure.

- Trade Balance: Friday, 9:00. The euro zone’s trade surprlus for January was slightly lower than usual but still high in absolute terms: 19.9 billion. A small rise to 20.2 billion is projected now.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar failed to conquer the 1.2335 level mentioned last week and dropped to lower ground.

Technical lines from top to bottom:

1.2555 is the three-year high the pair reached in mid-February. 1.2477 was the high point in March but did not hold up for long.

1.2445 capped the pair in early March and remains important. The next important level is only 1.2345 which capped the pair in early April.

Further below, 1.2270 was a swing low in mid-February and mid-March. The 1.2210 level which served as a cushion in April is the next level to watch.

1.2155 was a low point in early March and the last line before 1.2090, the 2017 high.

I remain bearish on EUR/USD

While the US Dollar may suffer from further worries about a trade war between China and the US, the euro is under pressure from signs of a slowdown already happening and Draghi may hit the common currency when it is down.

Our latest podcast is titled Volatility venting and Brexit can-kicking

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!