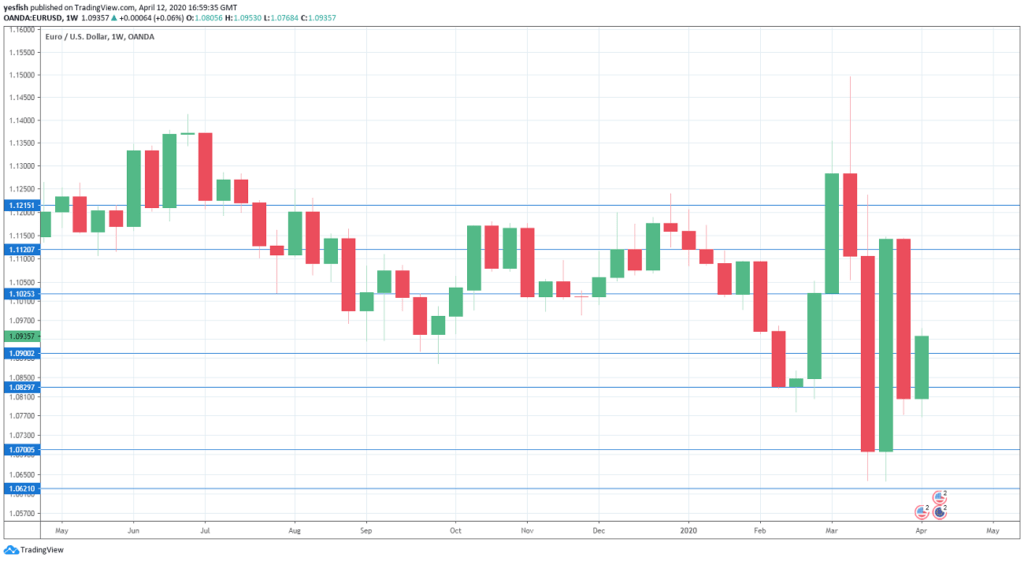

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Final CPI: Thursday, 6:00. The initial March reading for CPI came in at 0.1%, edging above the estimate of 0.0%. The final reading is expected to conform to this figure.

- Eurozone Industrial Production: Thursday, 9:00. The indicator rebounded in January with a gain of 2.3%, after a decline of 2.1% a month earlier. The estimate for February stands at -0.1%.

- Eurozone Inflation: Friday, 9:00. In the initial readings, the headline figure for March came in at 0.7%, while the core figure showed a gain of 1.0%. The final readings are expected to conform to the initial readings.

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.1215, which has held since mid-January. 1.1119 is next.

1.1025 (mentioned last week) switched to a resistance role last week.

1.0900 is an immediate support level. It could see action early next week.

1.0829 has switched to a support role after gains by EUR/USD last week.

The round number of 1.07 is next.

1.0620 is protecting the 1.06 level. It is the final support level for now.

.

I remain bearish on EUR/USD

The eurozone economy has been hard hit by the Corvid-19 virus, especially Italy and Spain. The dire financial situation could spark a debt crisis, which would likely dampen sentiment towards the euro.

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!