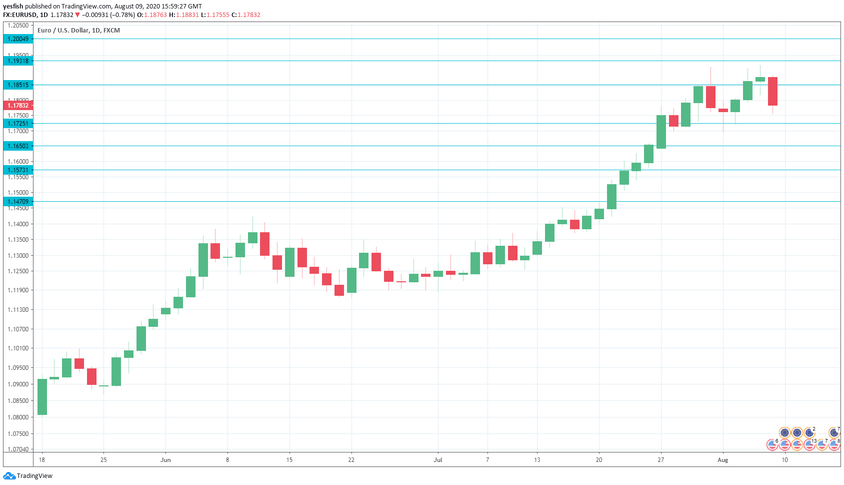

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Sentix Investor Confidence: Monday, 8:30. The indicator remains in negative territory, but the numbers have been improving. The July read improved to -18.2, up from 24.8, and the positive trend is expected to continue, with an estimate of -16.0.

- German ZEW Economic Sentiment: Tuesday, 9:00. German investor confidence softened, as ZEW Economic Sentiment fell to 59.3, down from 63.4. The downward trend is expected to continue, with an estimate stands at 55.0.

- Industrial Production: Wednesday, 9:00. After two sharp declines, industrial production rebounded in May, with a gain of 12.4%. Another double-digit gain is projected for June, with an estimate of 10.1%.

- German Final CPI: Thursday, 6:00. German inflation improved to 0.6% in June, up from -0.1% beforehand. The forecast for July stands at -0.5%.

- Flash GDP: Friday, 6:00. The eurozone economy declined by 12.1% in the Q2 initial estimate, and analysts are expecting that the second estimate will confirm this reading.

- All times are GMT

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2174.

This is followed by 1.2004, just above the psychologically important 1.20 level.

1.1930 is next.

1.1850 was tested in resistance last week.

1.1725 is providing support.

1.1650 is next.

1.1573 (mentioned last week) has some breathing room in support.

1.1470 has held since mid-March. It is the final support line for now.

.

I am neutral on EUR/USD

The euro has been pushing towards the lofty 1.20 level, as the US dollar has not looked sharp of late. Still, there are signs of a US recovery, which could raise confidence in the US dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!