- Current Account: Wednesday, 8:00. The eurozone current account surplus fell to 8.0 billion, the third straight month that the surplus has narrowed. We now await the June data.

- Inflation Report: Tuesday, 9:00. Inflation climbed rose to 0.3% in June, up from 0.1%. The forecast for July stands at 0.4%. The core reading ticked lower from 0.9% to 0.8% in June. Analysts expect a rebound in July, with an estimate of 1.2%.

- PMIs: Friday, 7:15 in France, 7:30 in Germany, and 8:00 for the whole eurozone. In June, PMIs across the eurozone posted readings above 50, which indicates expansion. This trend is expected to continue in the July releases. German Manufacturing PMI is expected to come in at 52.2, the Eurozone PMI at 52.7 and the French indicator at 53.0.

- All times are GMT

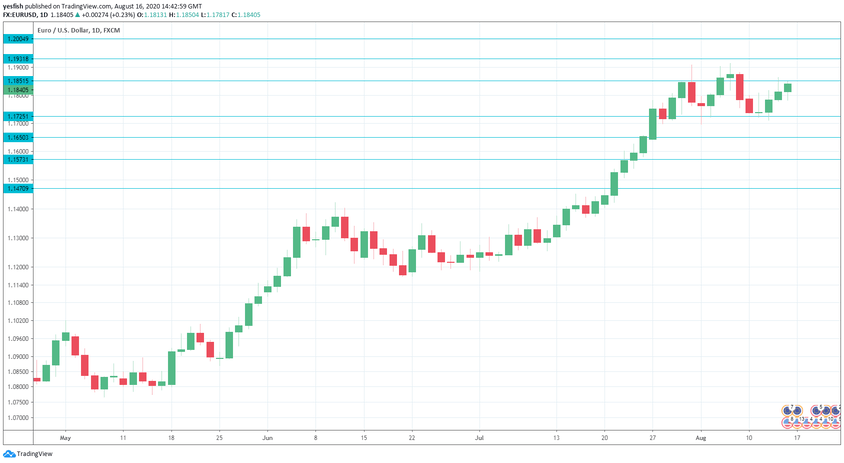

EUR/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2174.

This is followed by 1.2004, just above the psychologically important 1.20 level.

1.1930 is next.

1.1850 is a fluid line. Currently, it is an immediate resistance line.

1.1725 is the first support line.

1.1650 has some breathing room in support.

1.1573 (mentioned last week) is next.

1.1470 has held since mid-March. It is the final support line for now.

.

I am neutral on EUR/USD

The US dollar continues to struggle and the euro has taken advantage, testing the 1.19 line earlier in August. However, US numbers have been showing some improvement, so the dollar could rebound.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!